What is the interest coverage ratio?

Types of interest coverage ratios

Why and when the ICR is important

Interpretation of the interest coverage ratio

What is a good interest coverage ratio?

Imagine you run a business. Recently, you decided to expand it by hiring new employees and purchasing new equipment. However, since you do not have enough resources, you resort to securing a loan. The question remains whether you can repay the loan and interest.

How can you determine this? A special model called the interest coverage ratio can help one visualise a company's financial state and understand the amounts one can borrow as a business owner. Let's take a deeper look into the details.

What is the interest coverage ratio?

Simply put, the interest coverage ratio is a financial model that shows how easily a company can pay the interest on its debt. This model doesn't count the loan principal, giving a somewhat limited vision of the company's financial stability.

Here are some key features of the model:

- The interest coverage ratio focuses exclusively on interest payments. So, with a good enough ICR, repayment of the principal might still become an issue.

- The ICR doesn't take into account all the company's expenses. When calculating the ICR, you don't count taxes, operational costs, dividends, etc., so, you have to estimate them separately.

- This model focuses on the current company's state and doesn't allow you to make long-term predictions.

The interest coverage ratio is a specific number you calculate using a formula. Depending on your business' niche, this number will show your real ability to repay your loan interest. For example, your ICR can be 2.3.

How to calculate the ICR

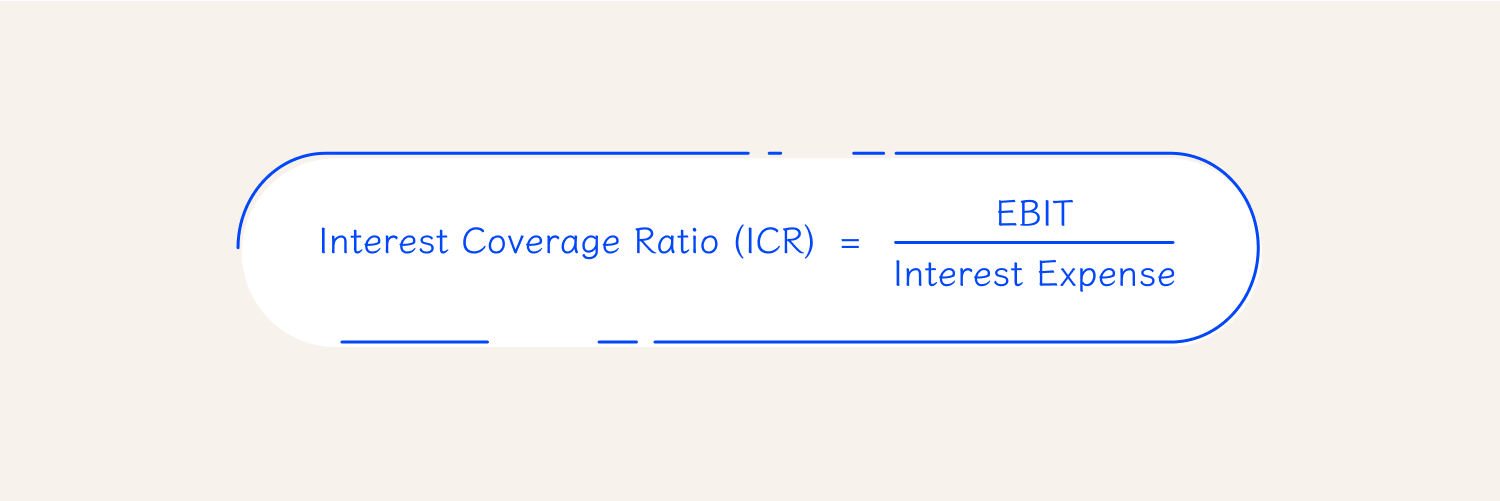

The interest coverage ratio is calculated with the following formula:

Let's break it down:

- EBIT is an abbreviation for earnings before interest and taxes. This is the amount a business earns from its regular activities before paying the loan interest and taxes.

- Interest Expense (Total Interest Amount) is the whole sum of the interest that a company will need to repay within the entire loan term.

Usually, ICR is calculated for a month, year, or quarter, depending on the company's repayment plan.

Let us consider an example:

Imagine you own an online electronics store. Your EBIT per month is $10,000—this is your revenue minus the costs of the electronics you sold, taxes, and operating expenses.

You took a loan to purchase new goods for your store. The total interest expense on this loan is $2,000. Using the formula, you get the following:

.png)

The result is exactly your ICR. It means you can pay your interest expense 5 times with the money you make from selling electronics. And, running a bit ahead, this is a pretty good ICR for the online selling niche.

Another example:

A big IT company has ended up with a negative EBIT for the past year. It means the company had more expenses than revenue. The EBIT was –$50,000. The interest expense for a supposed loan is $50,000.

In this case, the ICR is –1, which means the company won't be able to repay the interest, at least not now.

Types of interest coverage ratios

The interest coverage ratio formula with EBIT indicated above is the most straightforward and common. However, you need more insights about the company's ability to repay the interest.

Here are situations using other types of ICR can provide these additional insights:

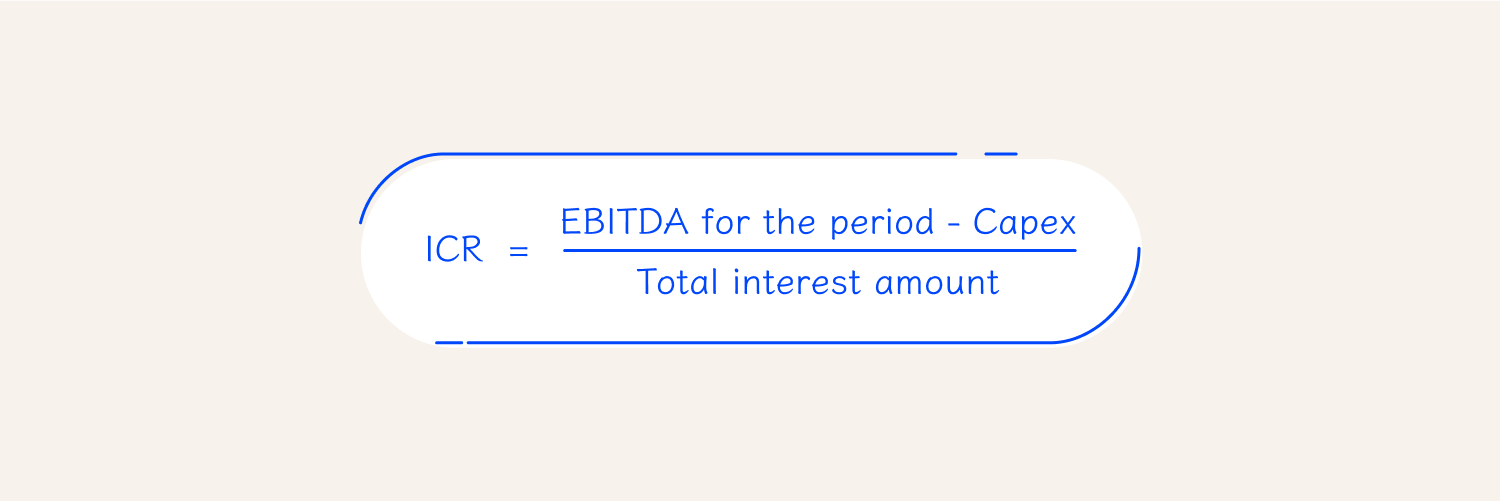

- EBITDA interest coverage ratio. EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortisation. This variation of ICR becomes helpful when you need to check the ability to pay interest without considering non-cash expenses. Such an approach gives a clearer picture of the cash flow.

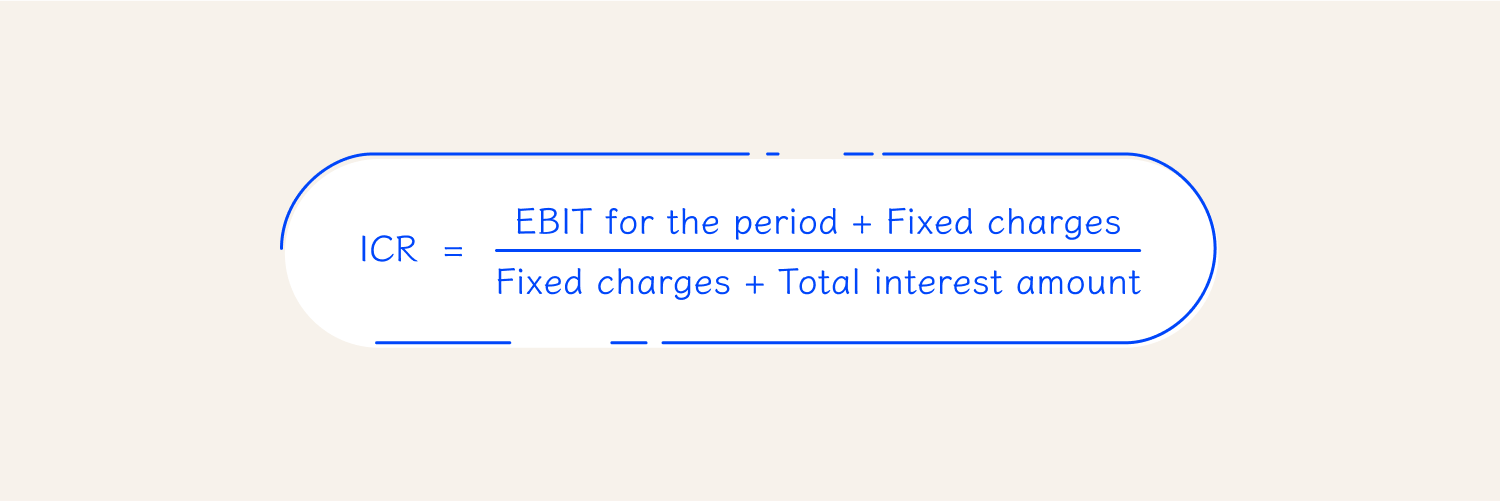

EBITDA interest coverage ratio formula:

.png)

- Fixed Charge Coverage Ratio. This interest coverage ratio is broader: it includes all the fixed payments alongside the interest. It helps estimate a company's overall ability to meet its fixed financial obligations.

- EBITDA Less Capex interest coverage ratio. With the help of this ratio, you can count money spent on maintaining or growing the company—Capital Expenditure, or Capex. It shows how well a company can pay its interest after these investments.

Why and when the ICR is important

Businesses calculate the ICR when they need to estimate the ability to repay outstanding debt's interest. Besides being an evident part of risk management before taking a loan, counting ICR is also important in the following situations:

- understanding the short-term financial health of the company

- estimating a perspective to get a particular loan amount

- proving financial stability and creditworthiness to investors and lenders

- managing the cash flow required for daily business activities

- getting an early warning of financial trouble in case the ICR is too low.

This metric is also helpful for traders and other market participants, who want to take out a loan and need to understand if they will be able to repay it.

Interpretation of the interest coverage ratio

So, you calculated the ICR Ratio and got a particular number. What does this number mean, and how can it help you make confident decisions? We will discuss this further.

What is a good interest coverage ratio?

There are no universal figures for an ICR. Depending on your business's niche, the 'good' ratio might vary from very small to pretty big numbers. A general benchmark is 3 or higher. ICRs are not usually very high and rarely exceed 30.

Here are some general guidelines:

- ICR 2 or higher. Generally, for most industries, this is a good ICR. It means that a business earns at least twice more than the interest amount and can safely take a loan.

- ICR from 1 to 2. Usually, such a ratio is also considered good enough. This might involve a higher risk than the ICR above 2 because the overall stability can be ruined if there are unexpected expenses.

- ICR lower than 1. This ratio shows the company can't afford the loan at the moment, and repaying the interest might lead to financial troubles, including default.

To give you some understanding of the numbers, we will show you the average ICRs among the U.S. companies by industry according to Readyratios.com:

| Food | 2.89 |

| Furniture and fixtures | 9.80 |

| Primary metal industries | 7.71 |

| Hotels and other lodging services | 2.52 |

| Automotive repair, services, and parking | 4.71 |

| Educational services | 3.76 |

Note: The figures can change from year to year and shouldn't be considered the ultimate basis for estimating your company's actual ICR.

Final thoughts

- The interest coverage ratio shows how easily a business or a person can pay the interest on the debt. This metric doesn't include the loan principal and other expenses.

- Counting the ICR is crucial before taking a loan and might also be helpful to get insights into the overall stability of the business. The depth of these insights might vary depending on the ICR type.

- In different niches, different ICRs are considered good. Generally, the ratio of 2 and higher is regarded as high. It shows that the company earns at least twice as much as the interest amount and can afford to take a loan.

- However, this metric is limited and can't give an extended view of the company's financial health. It should be calculated along with other expenses and costs.