Back

25 Oct 2022

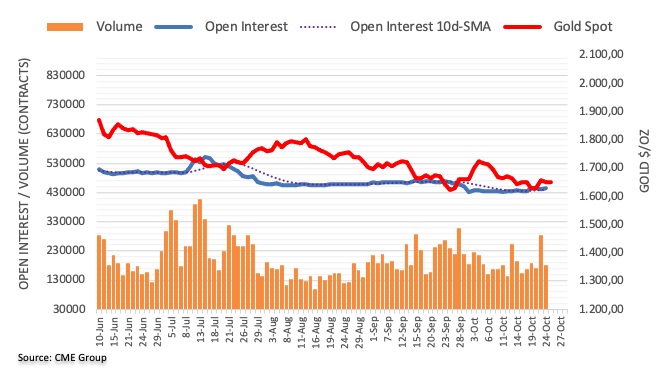

Gold Futures: Further downside in store near term

Considering advanced prints from CME Group for gold futures markets, open interest resumed the uptrend and went up by around 2.4K contracts on Monday. Volume, instead, maintained the choppiness intact and shrank by nearly 102K contracts.

Gold looks supported around $1,615

Gold started the week in a negative fashion amidst increasing open interest, suggesting that further decline remains on the cards in the very near term. That said, the door remains open for bullion to revisit the 2022 low at $1,614 (September 28).