Back

26 Oct 2022

Crude Oil Futures: Further range bound looks likely

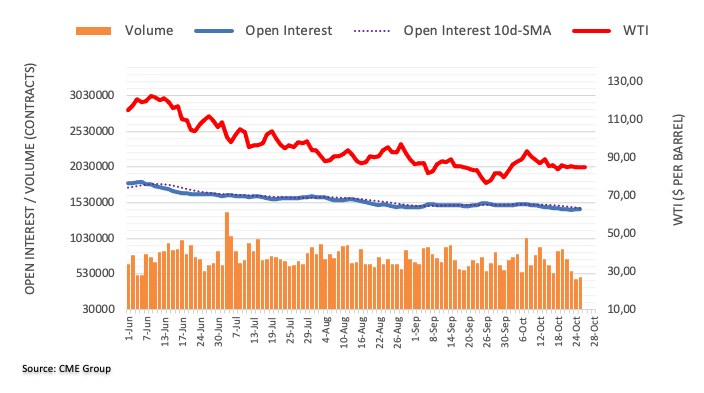

CME Group’s flash data for crude oil futures markets noted traders added around 3.1K contracts to their open interest positions on Tuesday, adding to the previous daily build. In the same line, volume reversed three daily retracements in a row and rose by nearly 30K contracts.

WTI: The next support of note comes at $80.00

Prices of the WTI traded in a volatile fashion and ended Tuesday’s session with small gains. The move was amidst increasing open interest and volume and leaves the door open to the continuation of the current consolidation. On the downside, prices face the next contention at the key $80.00 mark per barrel.