Back

27 Oct 2022

Crude Oil Futures: Recovery could extend further

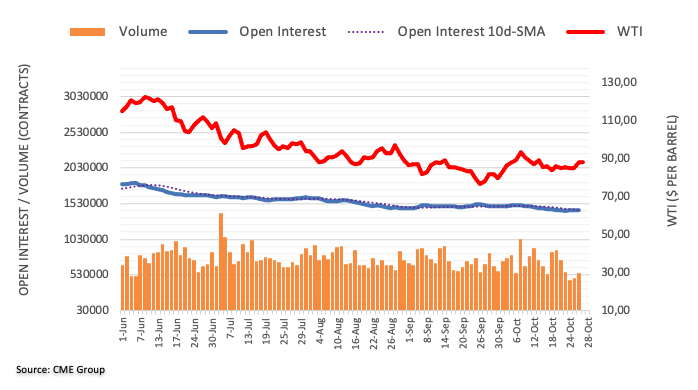

Open interest in crude oil futures markets rose by around 8.1K contracts on Wednesday, reaching the third consecutive daily build according to preliminary readings from CME Group. In the same line, volume added around 8.1K contracts to the previous daily.

WTI targets the October high near $93.60

Wednesday’s strong advance in prices of the WTI was accompanied by increasing open interest and volume, indicative that further gains appear likely in the very near term. That said, the immediate up barrier comes at the October peak at $93.62 (October 10).