Back

10 Mar 2023

Crude Oil Futures: Room for the continuation of the decline

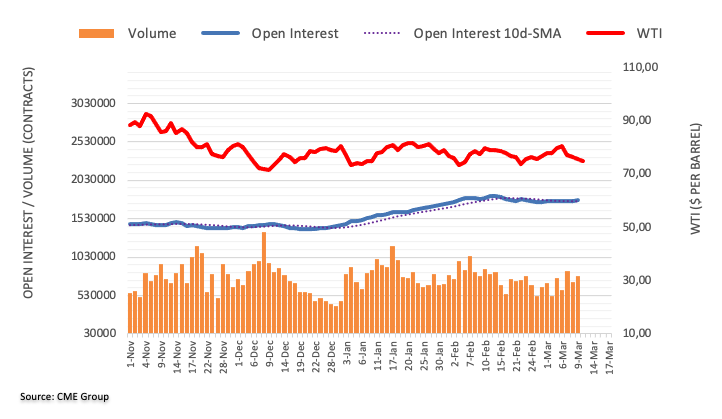

CME Group’s flash data for crude oil futures markets noted traders increased their open interest positions for the third consecutive session on Thursday, this time by around 10.3K contracts. Volume followed suit and rose by around 76.6K contracts.

WTI: En route to the 2023 low?

Prices of the barrel of the WTI extended the weekly leg lower on Thursday. The downtick was in tandem with rising open interest and volume and suggests that extra weakness lie ahead for the commodity. The breakdown of the February low at $73.83 (February 22) should open the door to a test of the 2023 low at $72.30 (February 6).