Back

14 Mar 2023

Crude Oil Futures: Scope for further losses

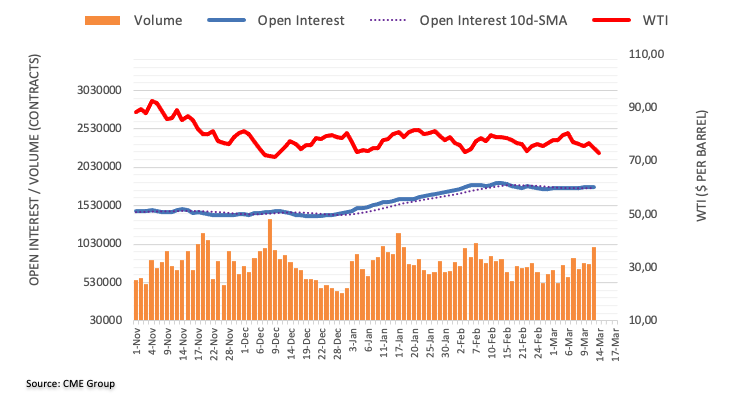

Open interest in crude oil futures markets increased for the fifth consecutive day on Monday, this time by around 4K contracts according to preliminary readings from CME Group. Volume followed suit and went up by nearly 226K contracts, reversing the previous daily drop.

WTI: Next on the downside comes $70.00

The WTI started the week on the back foot amidst increasing open interest and volume, which is indicative that further weakness lies ahead for the commodity, at least in the very near term. Against that, the loss of the 2023 low at $72.30 (February 6) could put the key $70.00 mark per barrel back on the traders’ radar.