Back

16 Mar 2023

Gold Futures: Strong recovery could take a breather

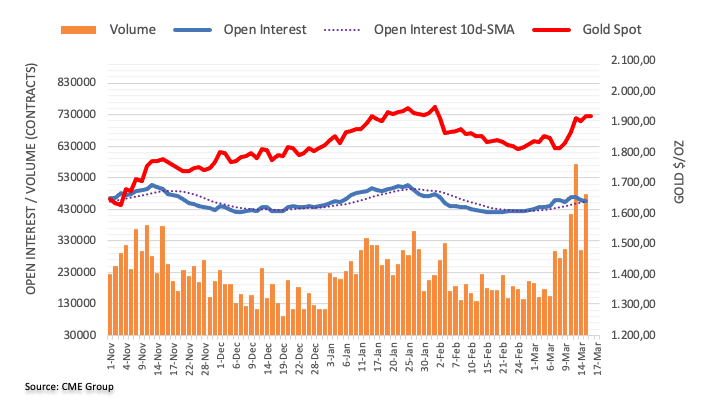

Open interest in gold futures markets shrank for the third session in a row on Wednesday, this time by around 2.8K contracts according to preliminary readings from CME Group. Volume, instead, resumed the uptrend and rose by around 178.8K contracts.

Gold: Interim support emerges at $1870

Gold prices advanced to new monthly highs near $1940 per ounce troy on Wednesday. The uptick, however, was accompanied by diminishing open interest and hints at the view that the current strong rebound could enter an impasse in the very near term. Immediately to the downside, the 55-day SMA at $1872 should offer provisional contention for the time being.