Back

16 Mar 2023

Natural Gas Futures: Further consolidation in the pipeline

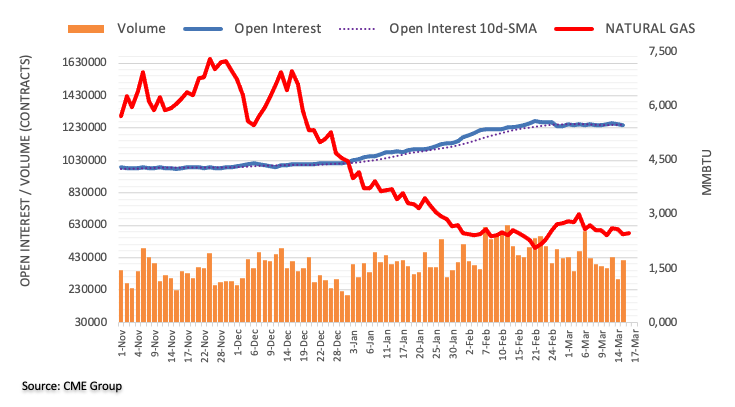

CME Group’s flash data for natural gas futures markets noted traders reduced their open interest positions for the second session in a row on Wednesday, this time by more than 10K contracts. On the other hand, volume kept the erratic activity well in place and went up by around 120.3K contracts.

Natural Gas faces extra range bound trade

Prices of the natural gas added to the previous daily pullback on Wednesday amidst shrinking open interest, which suggests that a potential rebound could be in the offing in the very near term. Looking ahead, the lack of strong drivers around the commodity is expected to leave the current consolidation well in place for the time being.