Back

27 Sep 2023

Gold Futures: Decline could be losing momentum

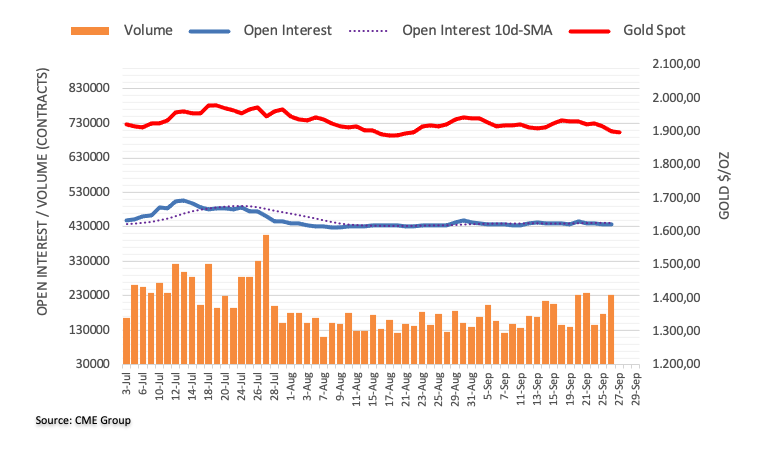

Open interest in gold futures markets shrank for the fourth session in a row on Tuesday, this time by just 123 contracts according to preliminary readings from CME Group. Volume, instead, increased for the second straight day, now by around 54.3K contracts.

Gold: Next on the downside emerges $1885

Gold prices extended the negative start of the week and close Tuesday’s session around the key contention area around $1900. The move was on the back of a small uptick in open interest, signalling that the leg lower might be running out of steam. The marked increase in volume, however, underpins further losses to, initially, the August low at $1885 per troy ounce.