Back

27 Sep 2023

Crude Oil Futures: Door open to extra upside

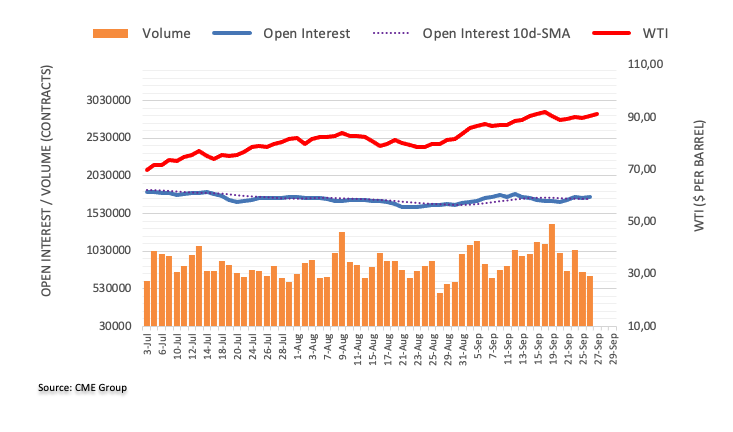

Considering advanced prints from CME Group for crude oil futures markets, open interest resumed the uptrend and went up by around 8.4K contracts, setting aside the previous daily pullback. On the other hand, volume dropped for the second consecutive session, this time by around 61.2K contracts.

WTI retargets the $92.00 mark and above

Prices of WTI resumed the upside o Tuesday, leaving behind Monday’s corrective decline. The daily uptick was accompanied by increasing open interest, which is indicative that further gains look likely in the very near term. Next on the upside for the commodity now emerges the September top around $92.60 per barrel (September 19).