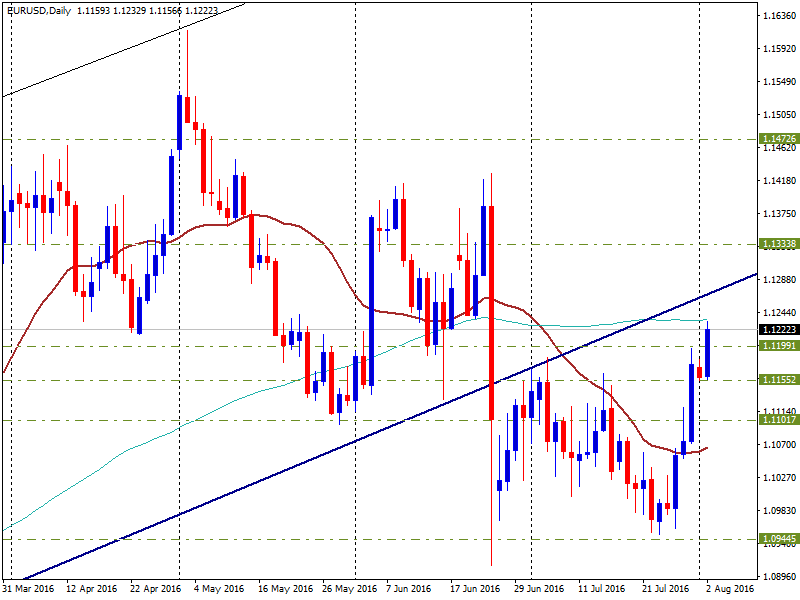

EUR/USD consolidates gains above 1.1200

After a pause on Monday, EUR/USD resumed the upside and rallied above 1.1200, reaching the highest level since the Brexit referendum results. The pair rose further during the American session and reached a fresh 5-week high at 1.1232.

It is about to end the session near the highs, significantly above 1.1200 and about to set the highest daily close since June 22. A weak greenback across the board boosted the pair to the upside. The US dollar dropped sharply in the market ahead of relevant US economic reports that includes the ADP report on Wednesday and the NFP on Friday.

Technical outlook

Today the pair re-confirm the break of the 1.1150 area and climbed breaking the 1.1200 handle. Momentum favors the upside but some readings signal overbought conditions.

The rally stopped below the 100-day moving average (or the weekly 20-SMA) at 1.1230/35, if the euro breaks and consolidates on top it would gain further strength.

The actual bullish momentum is likely to prevail as long as price holds above 1.1150 that has become a relevant support and is also where 20-SMA in four hours charts stands.