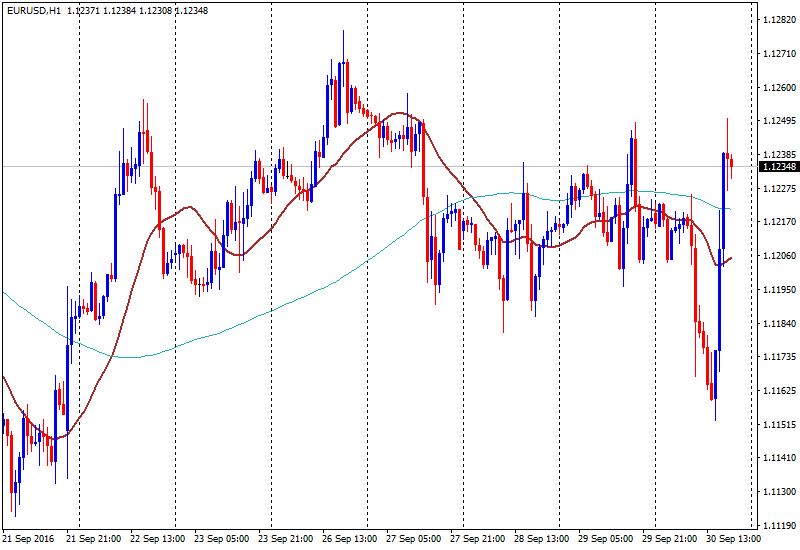

EUR/USD rebounds sharply, finds resistance at 1.1250

EUR/USD rebounded sharply from 1-week lows and climbed back above the 1.1200 handle. The rally was capped by the 1.1250 area and currently it trades at 1.1230/35, up 20 pips from yesterday’s closing price.

A weak US dollar across the board triggered the rally in the market. Equity prices recovered sharply in Europe and in Wall Street, reducing the demand for US dollar and also for the Japanese yen.

EUR/USD gain capped by 1.1250

Again the pair failed to break above the 1.21250 area that has become a key short-term resistance area. A break and a consolidation on top could open the doors for a test of the 1.1300 zone but it does not look likely to happen today.

Next week volatility in the EUR/USD pair and also across the forex market is expected to rise, taking into account that key employment data will be released in the US and will impact on market expectations regarding Federal Reserve rate policy.