Back

14 Aug 2018

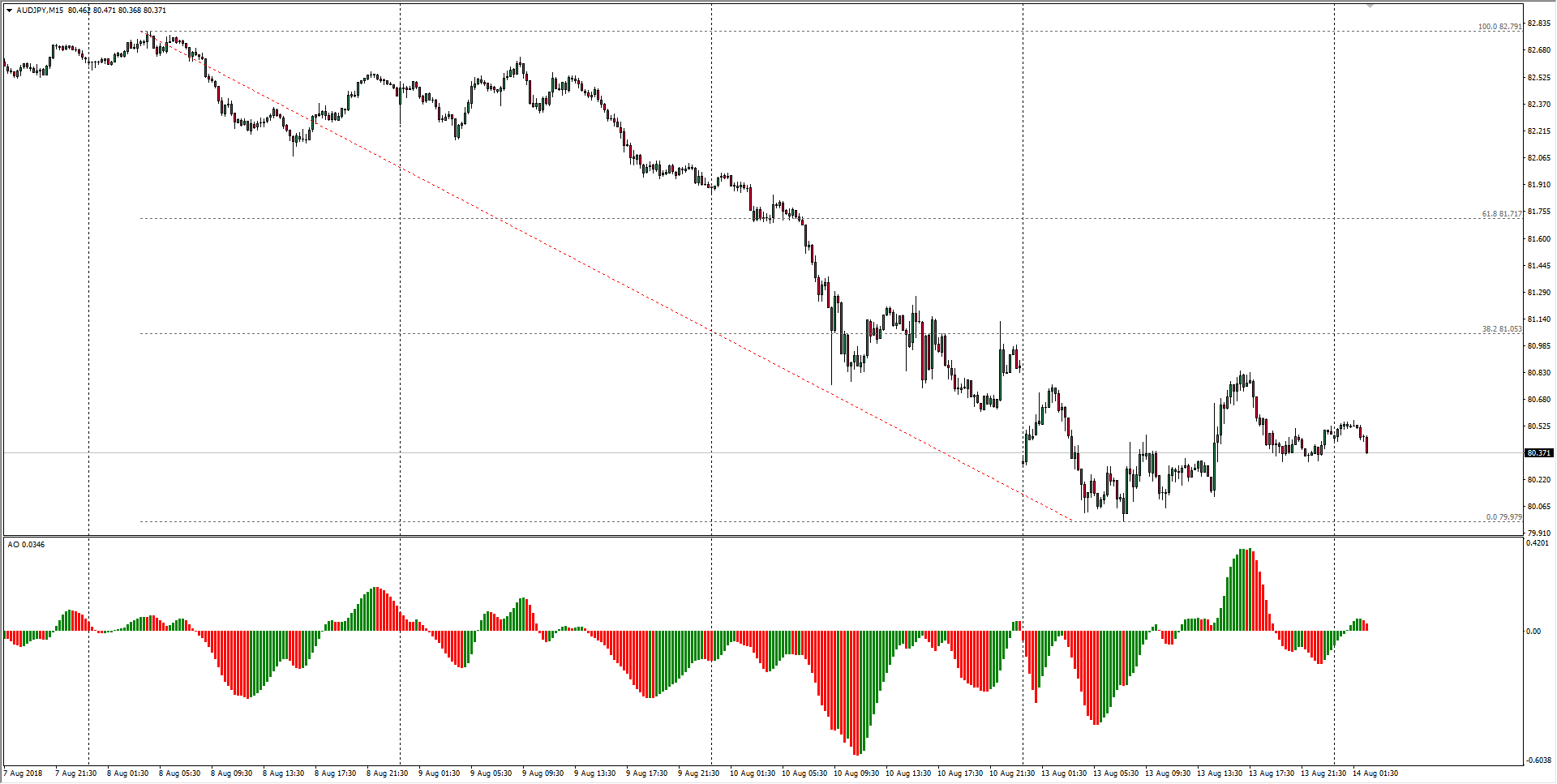

AUD/JPY Technical Analysis:bulls hoping to retake 81.00

- The Aussie has plunged against the safe-haven Yen as risk aversion takes over broader markets.

- AUD traders are looking towards Tuesday's China data dump, hoping for a pick-up to start rebuying.

- Current market tensions have seen the AUD/JPY dip into a new low for 2018.

AUD/JPY Chart, 15-Minute

| Spot rate: | 80.37 |

| Relative change: | -0.10% |

| High: | 80.55 |

| Low: | 80.35 |

| Trend: | Bearish |

| Support 1: | 80.35 (current day low) |

| Support 2: | 79.98 (current week low; major technical bottom) |

| Support 3: | 79.00 (major technical barrier) |

| Resistance 1: | 80.84 (current week high) |

| Resistance 2: | 81.05 (38.2% Fibo retracement level) |

| Resistance 3: | 81.97 (previous week high) |