Back

16 Nov 2018

S&P500 Technical Analysis: Inverse Head-and-Shoulders pattern - Correction over - Game on for bulls - 2,820.00 target

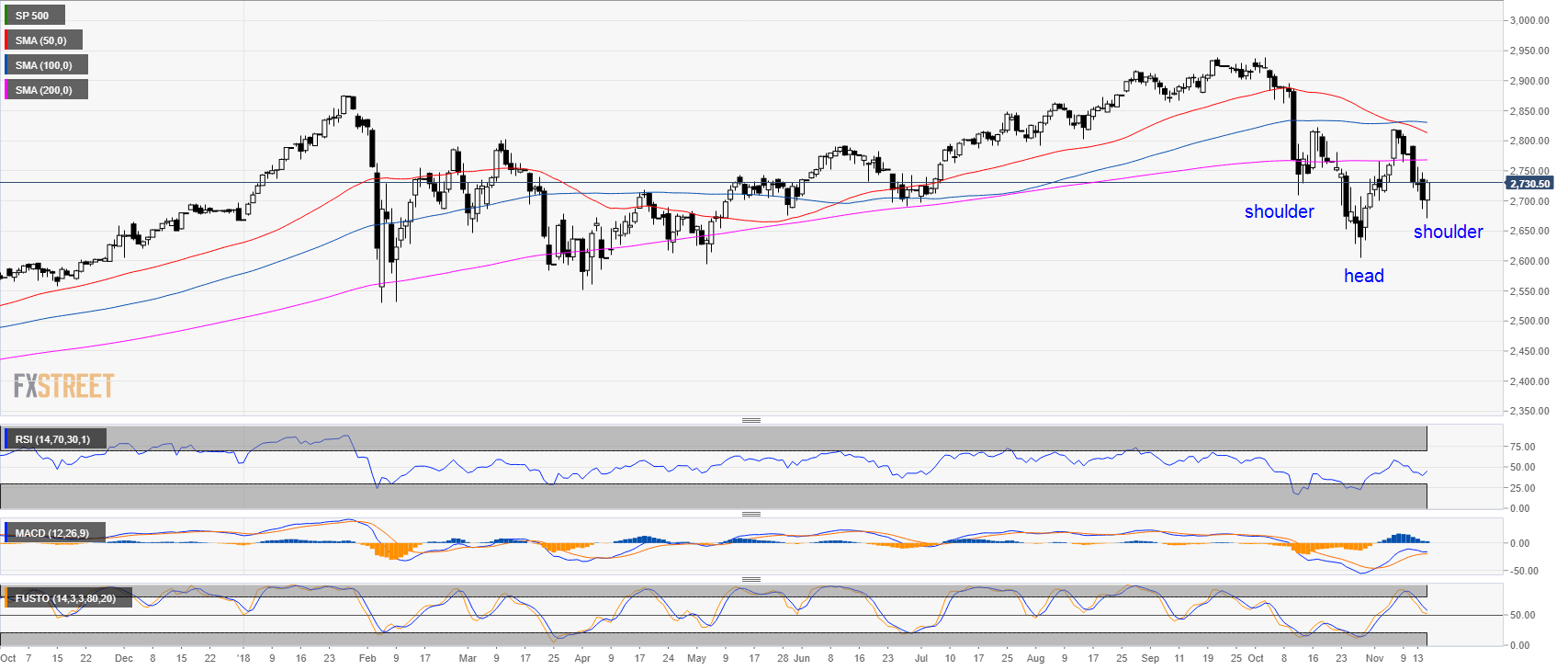

S&P500 daily chart

- The S&P500 an inverse head-and-shoulders pattern, which can potentially be bullish.

- The RSI is turning bullish, while the MACD and Stochastic are already in positive territories.

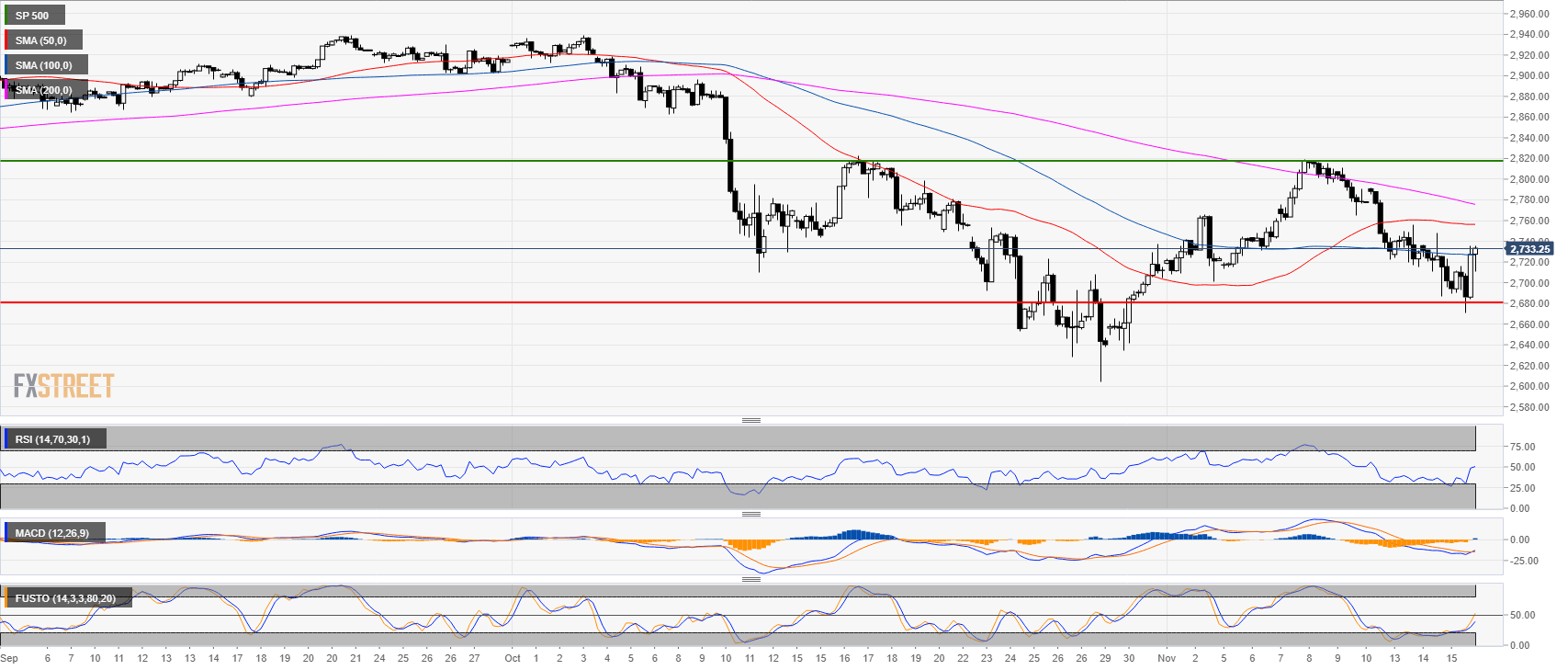

S&P500 4-hour chart

- The S&P500 found strong support at the 2,680.00 level as the bulls reclaimed the 50-period simple moving average (SMA).

- Technical indicators are picking up speed suggesting continued bullish momentum.

- The bull target is at 2,820.00 swing high. A bear breakout below 2,680.00 would be considered rather bearish.

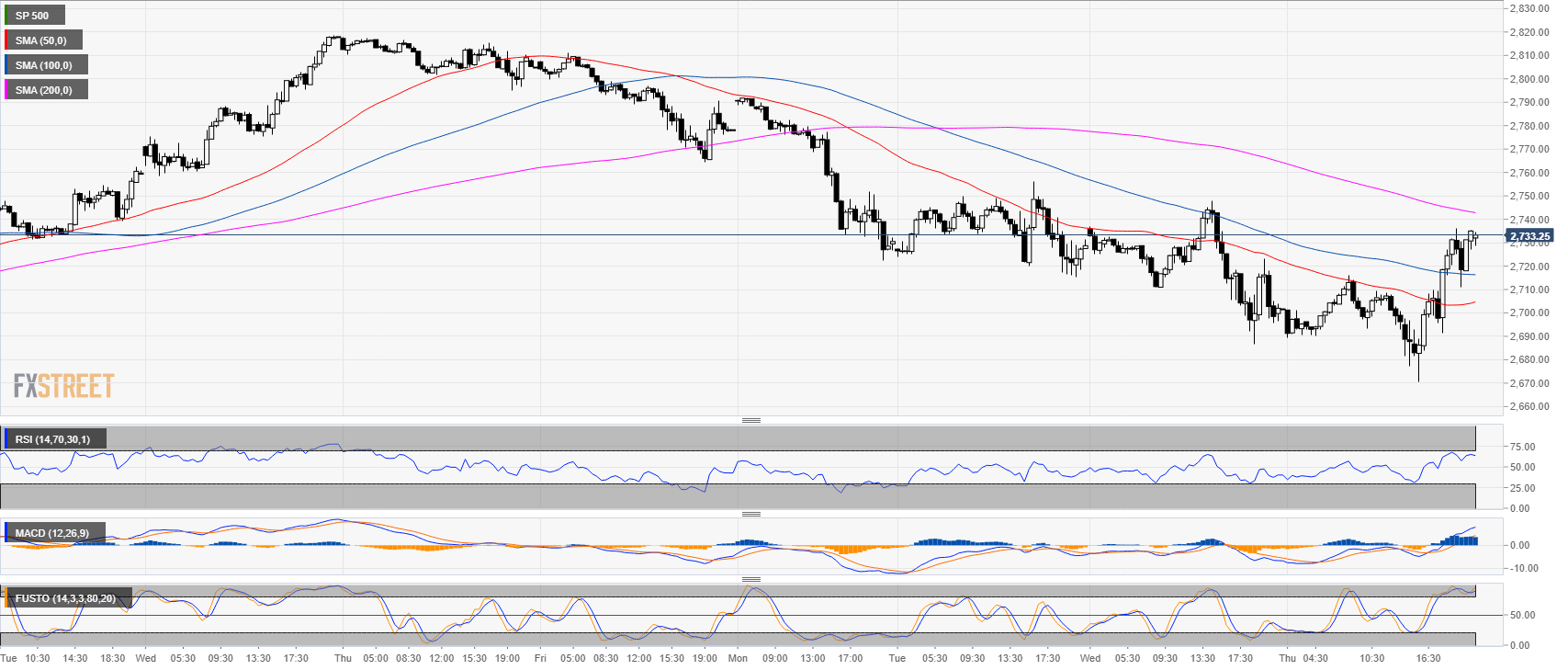

S&P500 30-minute chart

- The market is almost in full bullish mode on the 30-minute chart.

- The S&P500 broke above the 50 and 100 SMA while technical indicators are in positive territories.

Additional key levels at a glance:

SP 500

Overview:

Last Price: 2733.25

Daily change: 3.2e+3 pips

Daily change: 1.17%

Daily Open: 2701.75

Trends:

Daily SMA20: 2730.8

Daily SMA50: 2816.8

Daily SMA100: 2831.22

Daily SMA200: 2768.04

Levels:

Daily High: 2748

Daily Low: 2686.5

Weekly High: 2818.75

Weekly Low: 2713.5

Monthly High: 2939.5

Monthly Low: 2604.5

Daily Fibonacci 38.2%: 2709.99

Daily Fibonacci 61.8%: 2724.51

Daily Pivot Point S1: 2676.17

Daily Pivot Point S2: 2650.58

Daily Pivot Point S3: 2614.67

Daily Pivot Point R1: 2737.67

Daily Pivot Point R2: 2773.58

Daily Pivot Point R3: 2799.17