Back

9 Jan 2020

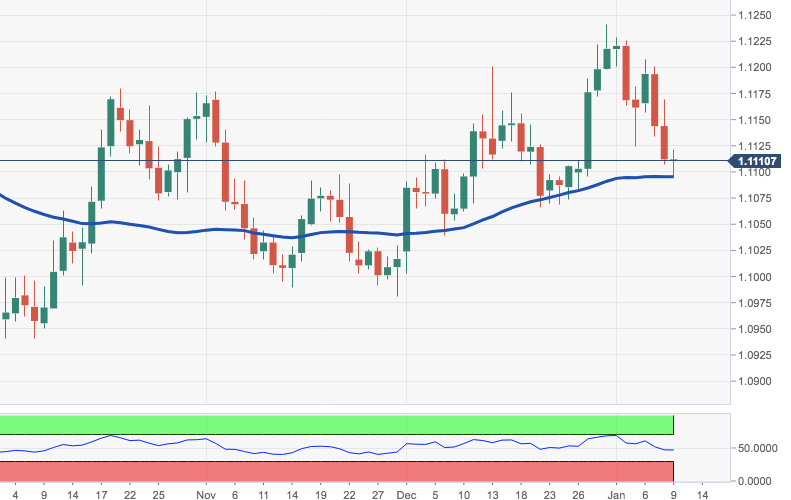

EUR/USD Technical Analysis: Negative below the 55-day SMA

- EUR/USD extends the downside and pierces the key support at 1.1100.

- The pair now shifted its focus to the 55-day SMA.

EUR/USD faded the initial optimism on the back of the renewed sentiment in the risk-associated complex.

The bullish move that started in early December appears to have lost momentum, leaving an interim top in the vicinity of 1.1240 (December 31st) for the time being.

On the downside the 55-day SMA remains the key magnet. Below this level the outlook on the pair should shift to bearish.

EUR/USD daily chart