Back

16 Jan 2020

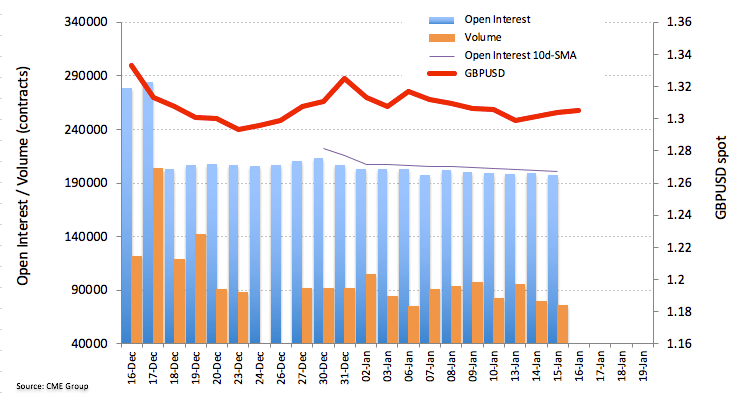

GBP Futures: bullish with caution

CME Group’s preliminary data for GBP futures markets noted investors scaled back their open interest positions by nearly 1.4K contracts on Wednesday. Volume followed suit and decreased for the second straight session, this time by around 3.6K contracts.

GBP/USD risks a correction lower

Short covering was behind Cable’s move up on Wednesday to levels beyond the critical mark at 1.30 the figure, as noted by declining open interest and volume. That said, while further gains are not ruled out in the very near-term, the likeliness of a downside correction seems to be gathering traction.