Back

21 Jan 2020

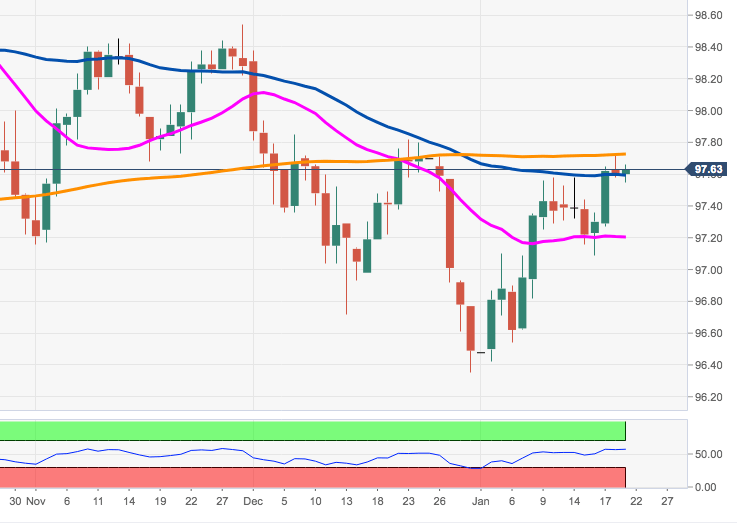

US Dollar Index Price Analysis: Failure at 97.70 could spark some correction

- The upside impulse in DXY run out of steam in the 97.70 so far.

- Above this level the outlook on the USD should shift to constructive.

The index met a tough hurdle in the 97.70 region, where sits the key 200-day SMA and so far yearly highs.

A breakout of this area on a convincing fashion should expose a Fibo retracement of the 2017-2018 drop and the 100-day SMA, both at 97.87.

If, on the other hand, sellers regain the upper hand, DXY faces the next support at the 21-day SMA at 97.19 ahead of last week’s low at 97.09.

DXY daily chart