US Dollar Index eases from 2020 highs just below 100.00

- DXY gives away some gains after hitting fresh yearly highs at 99.91.

- The solid momentum around the dollar looks unabated so far.

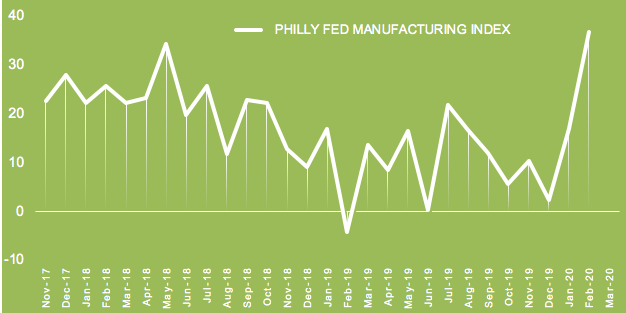

- US Philly Fed manufacturing index crushed estimates in February.

Another session, another 2020 high for the greenback, as the US Dollar Index (DXY) advanced to the 99.90/95 band earlier on Thursday, just to shed some pips soon afterwards.

US Dollar Index stays supported by data, JPY-selling

The upside momentum surrounding the index remains well and sound for yet another session, although it has run out of steam just ahead of the psychological barrier at 100.00 the figure on Thursday.

As usual in past sessions, auspicious results from the US docket lent extra oxygen to the buck on Thursday, after the Philly Fed manufacturing gauge came in well above estimates at 36.7 for the current month. Additional data saw weekly Claims rising to 210K and taking the 4-Week Average to 209.00K from 212.25K.

Also sustaining the upside in the buck, USD/JPY continues its strong march north in response to increasing speculation regarding the possibility that the Japanese economy could enter into recession in the near-term, all fuelling the sharp depreciation of the yen.

It is worth mentioning that, in general, better-than-expected results in the key US fundamentals could prompt market participants to start pricing in the likeliness that the Fed might not be “forced” to implement another “insurance cut” later this year, which could be also lending extra legs to the buck’s rally.

What to look for around USD

The index has extended the march north to new 2020 highs just below 100.00 the figure earlier on Thursday, keeping the bid bias well in place for the time being. Investors are expected to keep looking to the performance of US fundamentals and the broader risk appetite trends for direction as well as any fresh developments from the COVID-19. In the meantime, the outlook on the dollar remains constructive and bolstered by the current “appropriate” monetary stance from the Fed (once again confirmed at the FOMC minutes on Wednesday) vs. the broad-based dovish view from its G10 peers, the “good shape” of the domestic economy, the buck’s safe haven appeal and its status of “global reserve currency”.

US Dollar Index relevant levels

At the moment, the index is gaining 0.11% at 99.70 and a breakout of 99.91 (2020 high Feb.20) would aim for 100.00 (psychological barrier) and finally 101.34 (monthly high Apr.10 2017). On the flip side, immediate contention emerges at 98.94 (23.6% Fibo retracement of the 2020 rally) seconded by 98.54 (monthly high Nov.29 2019) and then 98.46 (38.2% Fibo retracement of the 2020 rally).