Back

13 Mar 2020

S&P500 New York Price Forecast: Stocks halted on 7% limit up circuit breaker, Index near 2600 level

Circuits breakers are stopping trading on the S&P500 Index in order to prevent overcrowding.

- If the S&P500 is up 7%, trading will pause for 15 minutes.

- If S&P500 is up 13%, trading will again pause for 15 minutes.

- If S&P500 is up 20%, the market would close for the day.

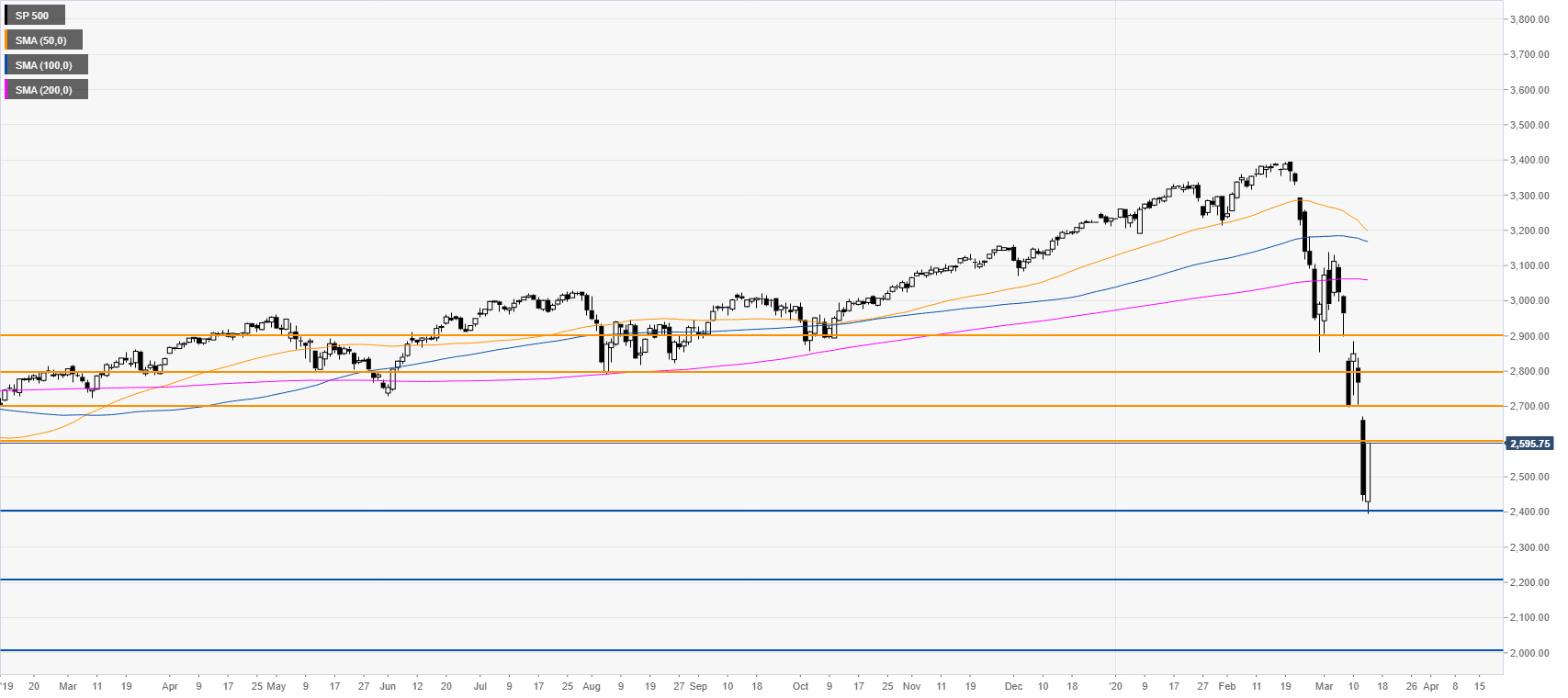

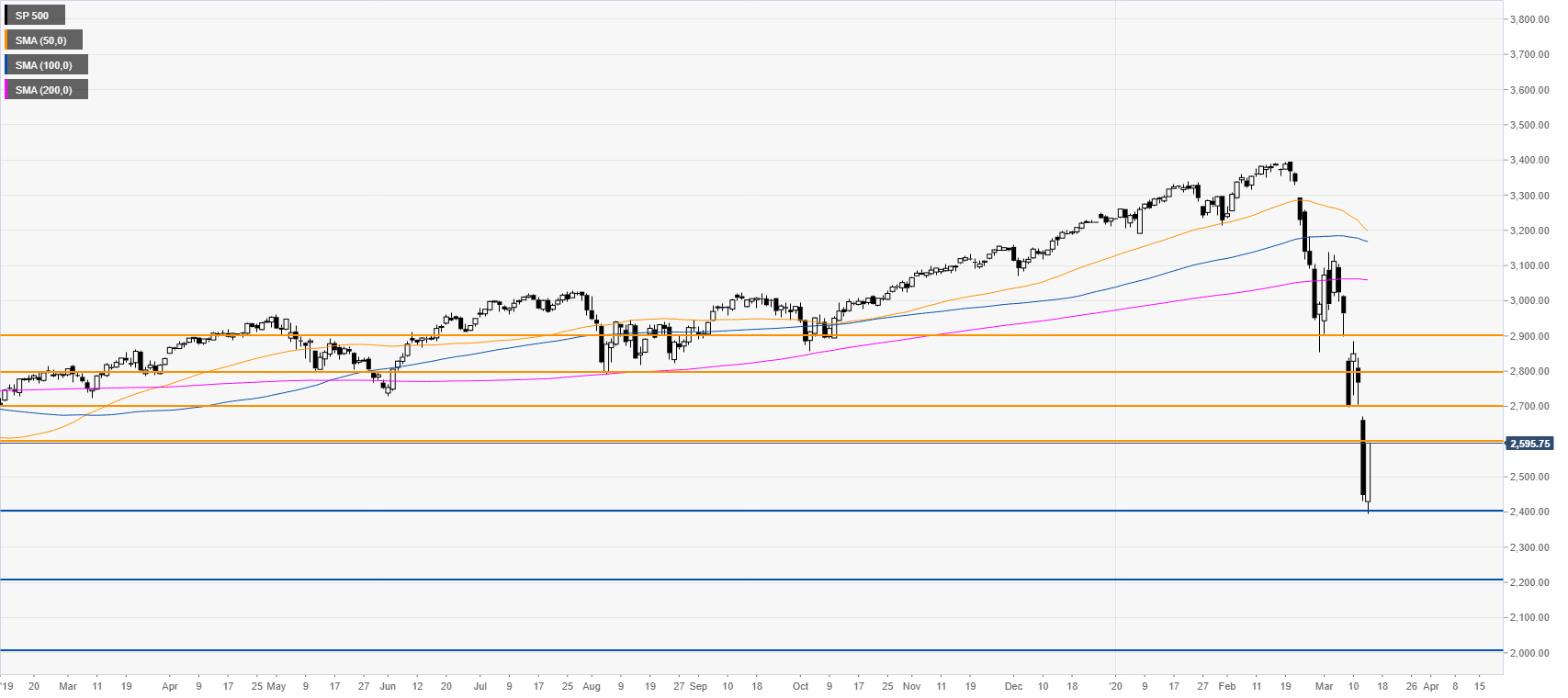

S&P500 daily chart

The S&P500 futures are pulling back up sharply after one of the worst days in history yesterday (Thursday) as the Coronavirus is making the world becoming hysterical and irrational. If the correction extends above 2600, the market could climb towards the 2700 and 2800 price levels. However, the market is strongly down and this may prove to be dead-cat bounce if the 2400 support fails to hold prices.

Additional key levels