Back

13 Mar 2020

USD/JPY New York Price Forecast: Yen down vs. US dollar despite Coronvirus hysteria

- USD/JPY is rebounding sharply from the 2020 lows as US stocks recover.

- USD/JPY is adding about 2.5% on an intraday basis.

- UoM Consumer Sentiment at 95.9, shrugging off coronavirus concerns, stocks hold onto gains.

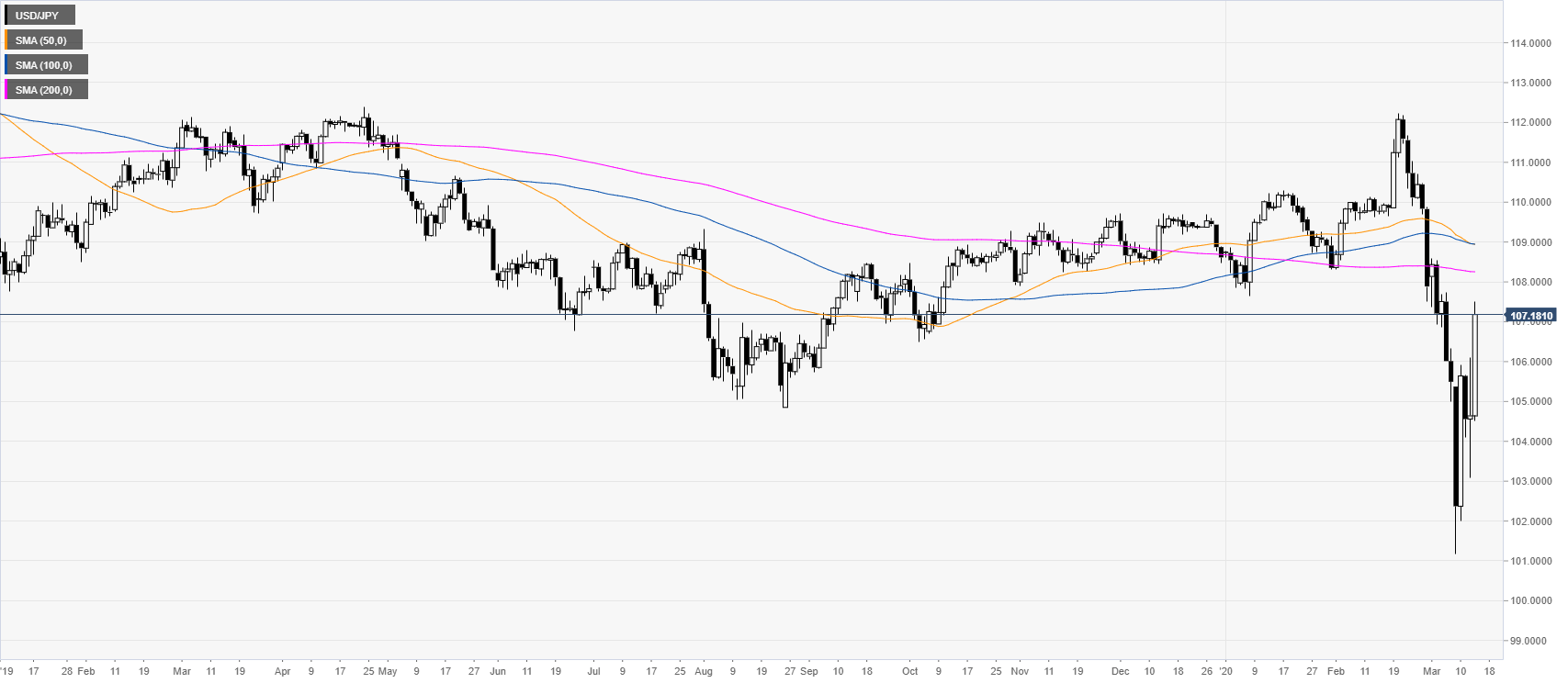

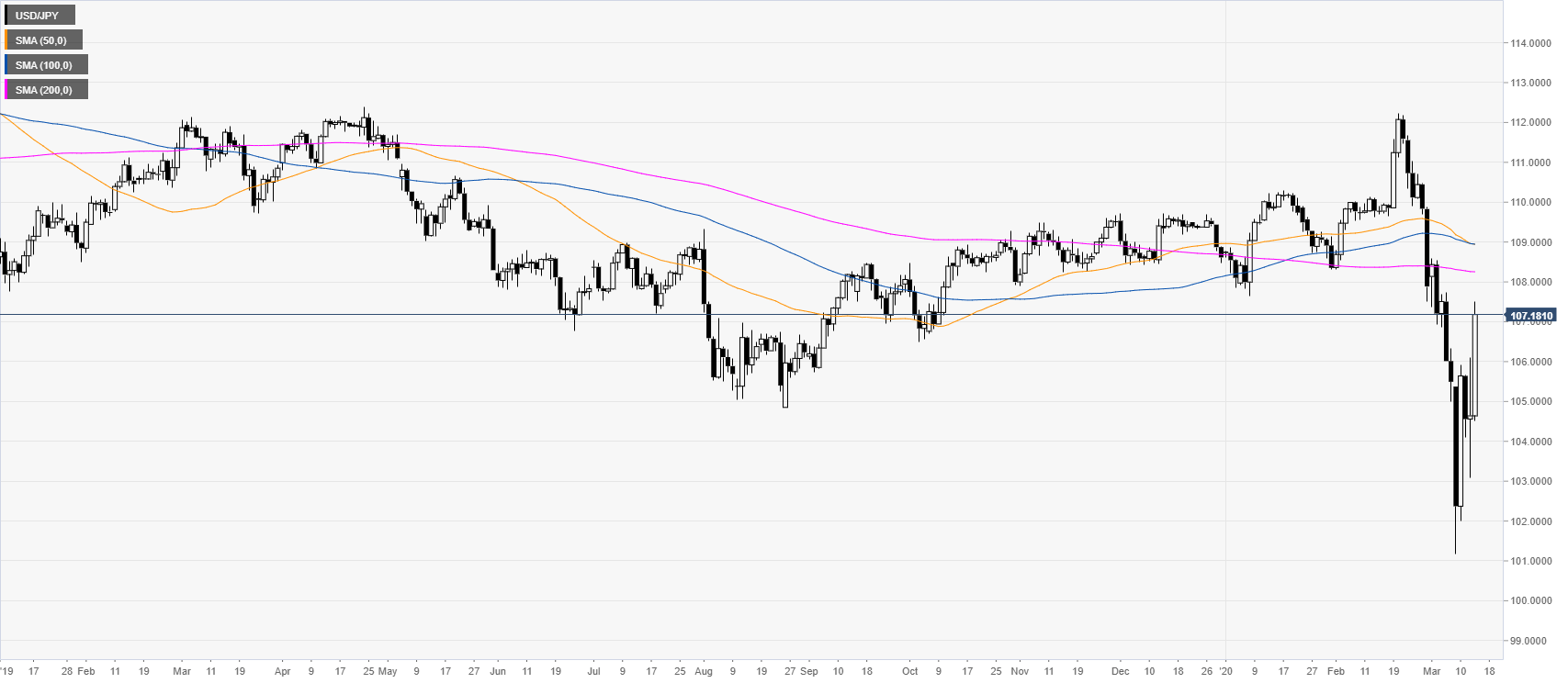

USD/JPY daily chart

USD/JPY is bouncing from three-year lows while below the simple moving averages (SMAs) as the equity markets are rebounding after one the worst sessions in history this Thursday as the Coronavirus narrative is fitting the bill as a pretext for worldwide hysteria and unprecedented alarmist messages from mass media for a flu pandemic. Additionally, freshly released the University of Michigan's initial gauge of consumer confidence came in at 95.9, above the 95 level.

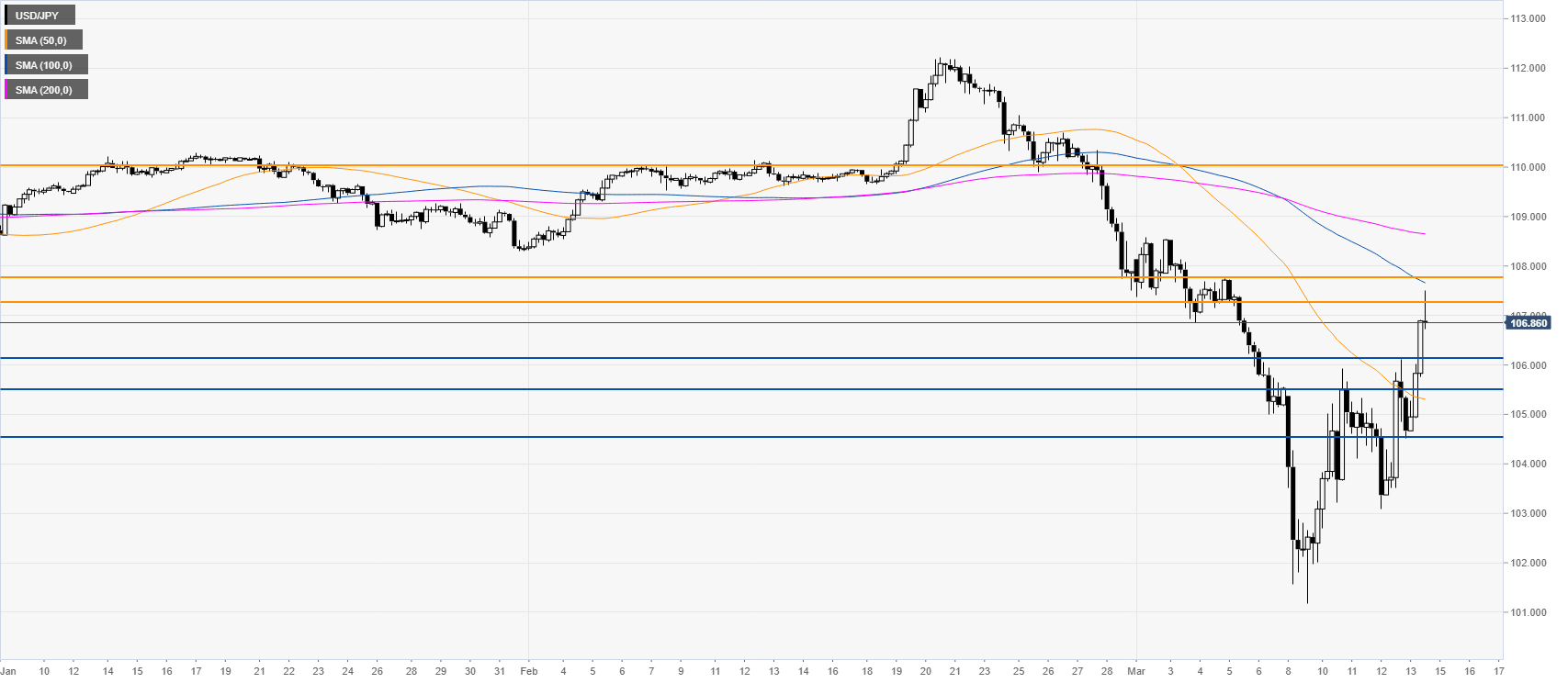

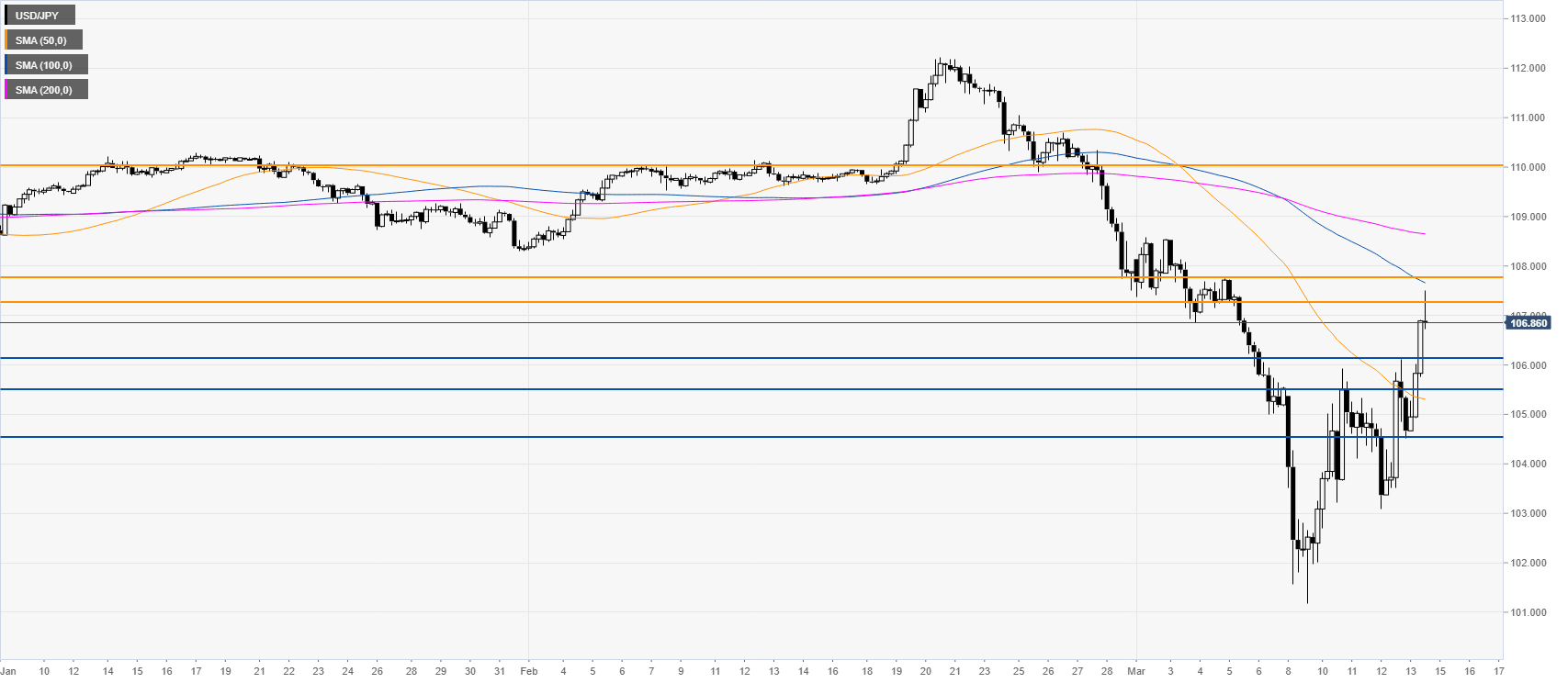

USD/JPY four-hour chart

USD/JPY is challenging the 107.00 figure and the 100 SMA on the four-hour chart. Bulls are recovering ground lost in the last weeks and a break beyond the 107.77 resistance can potentially lead to a run to the 110.00 figure. Support can be seen near the 106.21 and 105.50 levels.

Resistance: 107.32, 107.77, 110.00

Support: 106.21, 105.50, 104.50

Additional key levels