Back

13 Mar 2020

USD/MXN Price Analysis: Mexican Peso attempts a recovery after massive

The Mexican peso is attempting a recovery, with USD/MXN trading just under 22 after nearing 23 on Thursday. The US dollar has been attracting safe-haven flows amid a massive sell-off in stocks in response to growing fears related to coronavirus.

The US is moving closer to coordinated action as Democrats and Republicans are nearing an agreement on relief measures.

The number of cases in Mexico remains low. According to data compiled by John Hopkins, 12 cases are confirmed and eight have confirmed. While the figures are low in comparison to other countries, a fall in global demand is weighing on the peso. Moreover, oil prices have tumbled down.

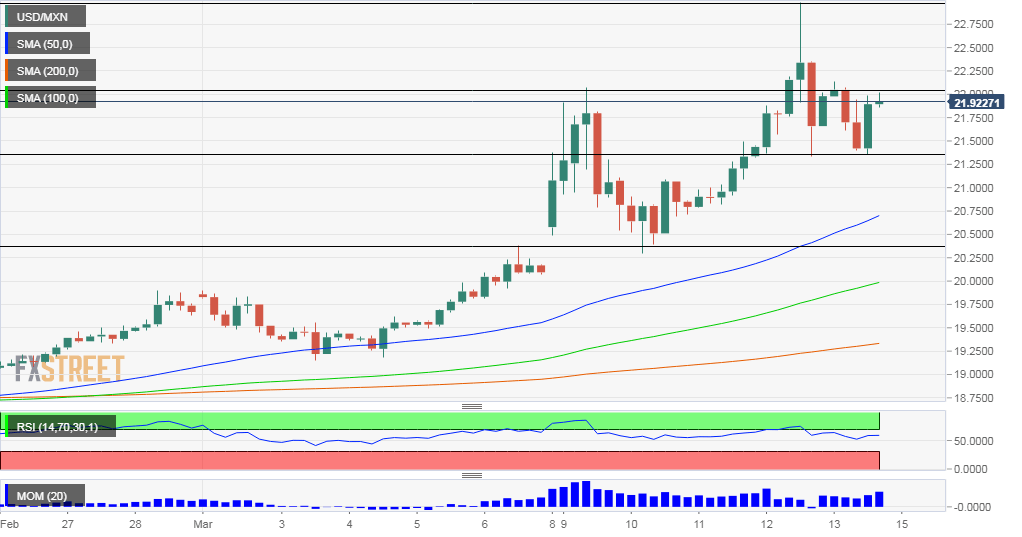

USD/MXN Forecast Chart

Dollar/peso has support at 21.30, followed by 20.40. Resistance is at 22.05, followed by 23.