Back

16 Mar 2020

Gold Futures: Rebound in the offing?

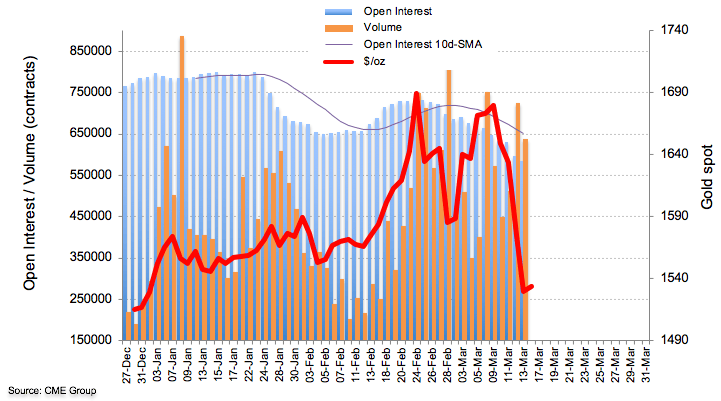

In light of preliminary data from CME Group for Gold futures markets, open interest extended the downtrend on Friday, shrinking by nearly 10.5K contracts. In the same line, volume reversed two builds in a row and went down by around 88.1K contracts.

Gold looks supported by the 200-day SMA

Prices of the ounce troy of gold dropped markedly on Friday in tandem with declining open interest and volume, leaving the prospects for a deeper pullback somewhat flat for the time being. That said, there is scope for a rebound to, initially, a Fibo retracement of the December-March rally at $1,608.25/oz, while the key 200-day SMA - today at $1,498.30 - is expected to hold the downside for the time being.