Back

16 Mar 2020

GBP/USD New York Price Forecast: Pound under heavy pressure in five-month lows, fast approaching 1.2200 figure

- GBP/USD is dropping sharply, now nearing the 1.2200 figure.

- The level to beat for bears is the 1.2230 support.

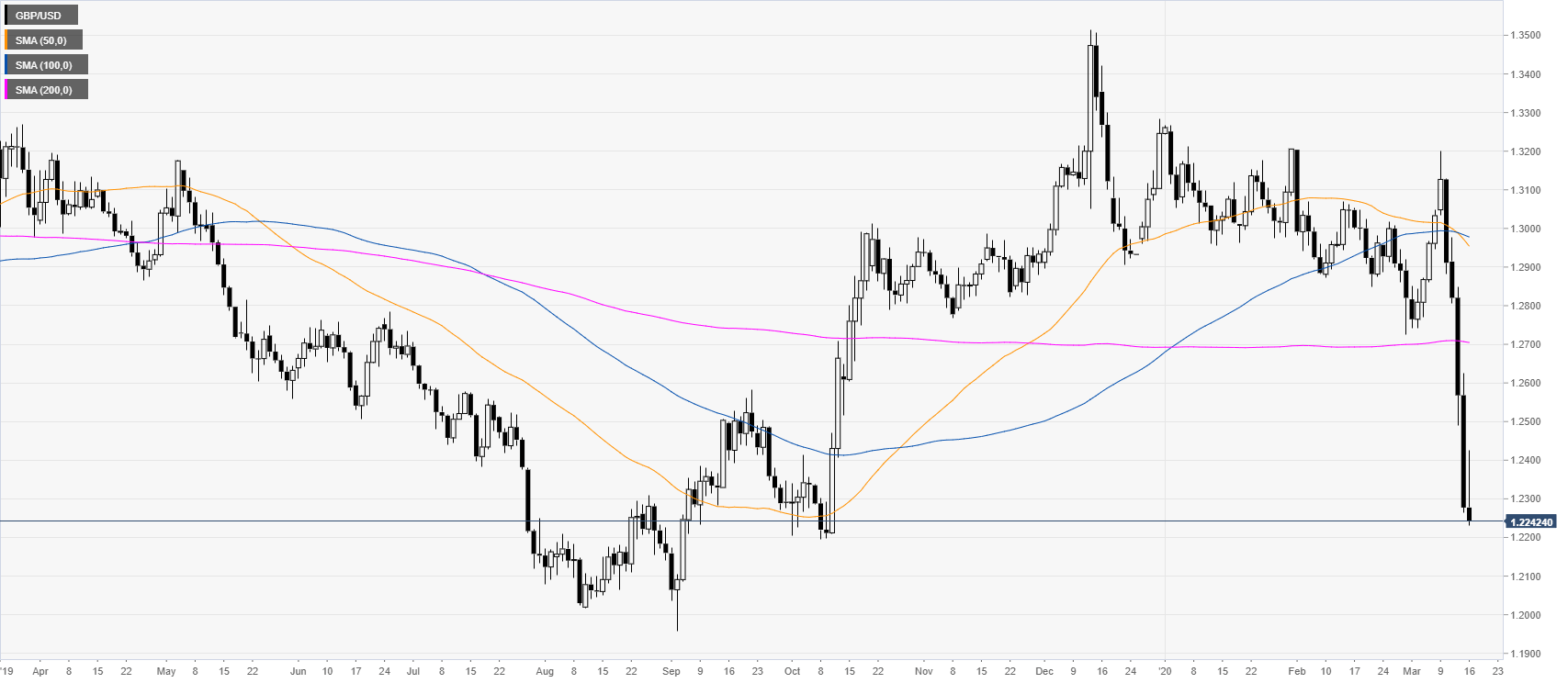

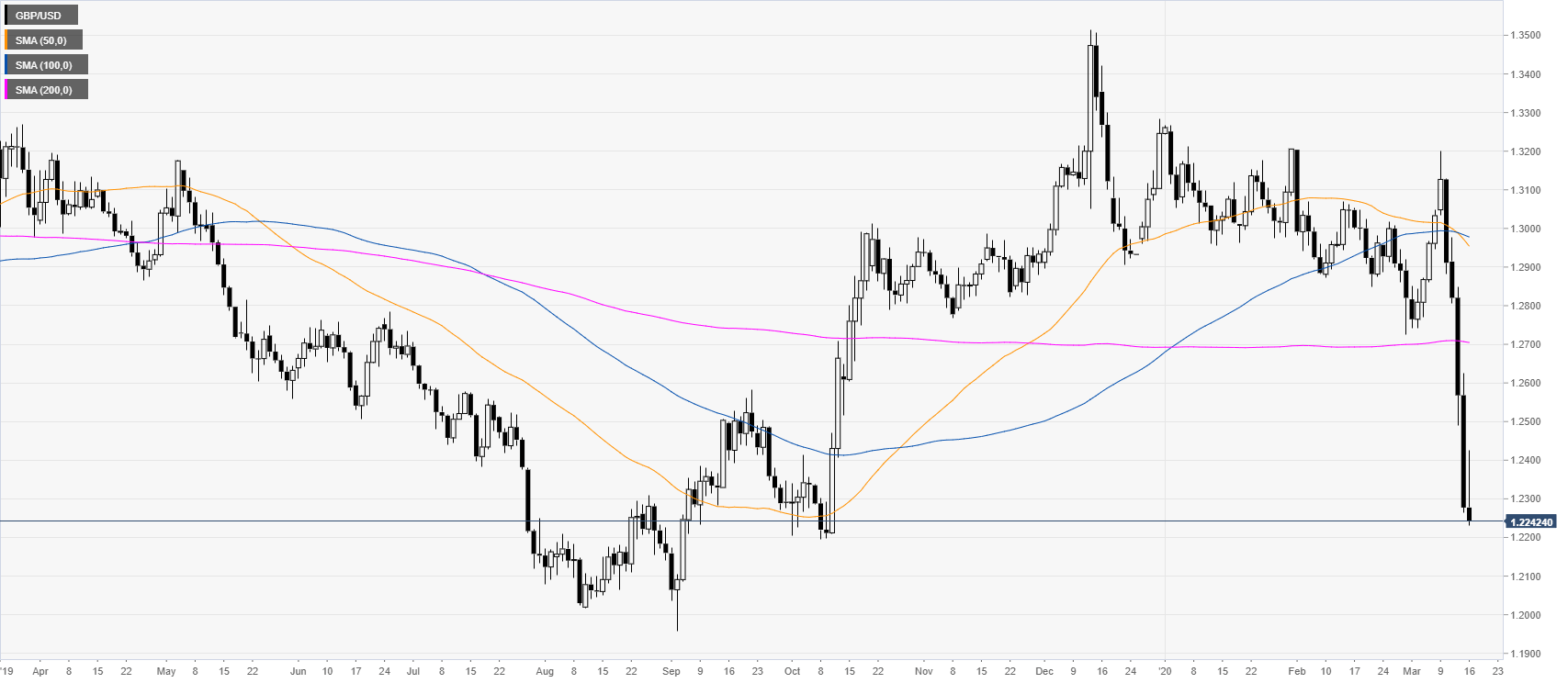

GBP/USD daily chart

GBP/USD is dropping like a stone in March 2020 as the market is nearing its lowest point since October 2019. Despite the overnight Fed cut, GBP/USD remains extremely weak.

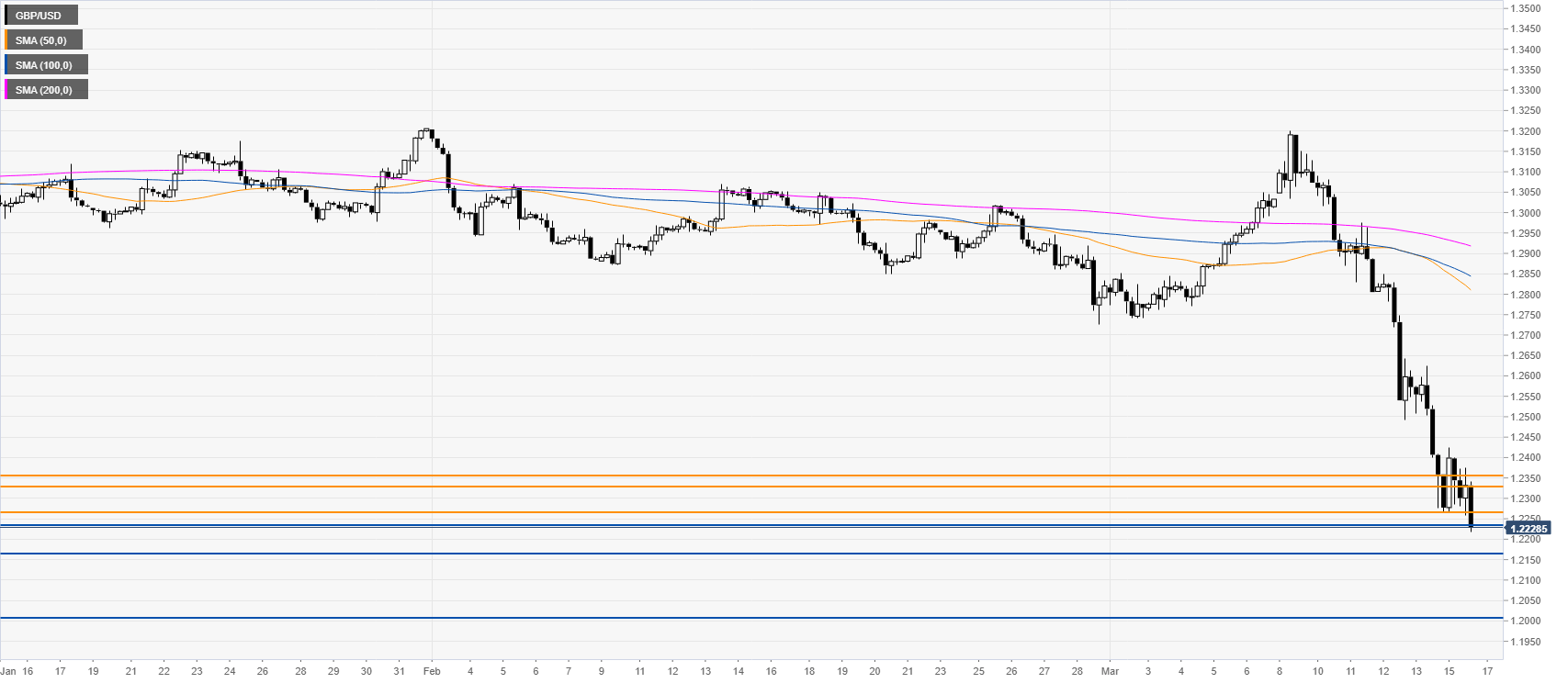

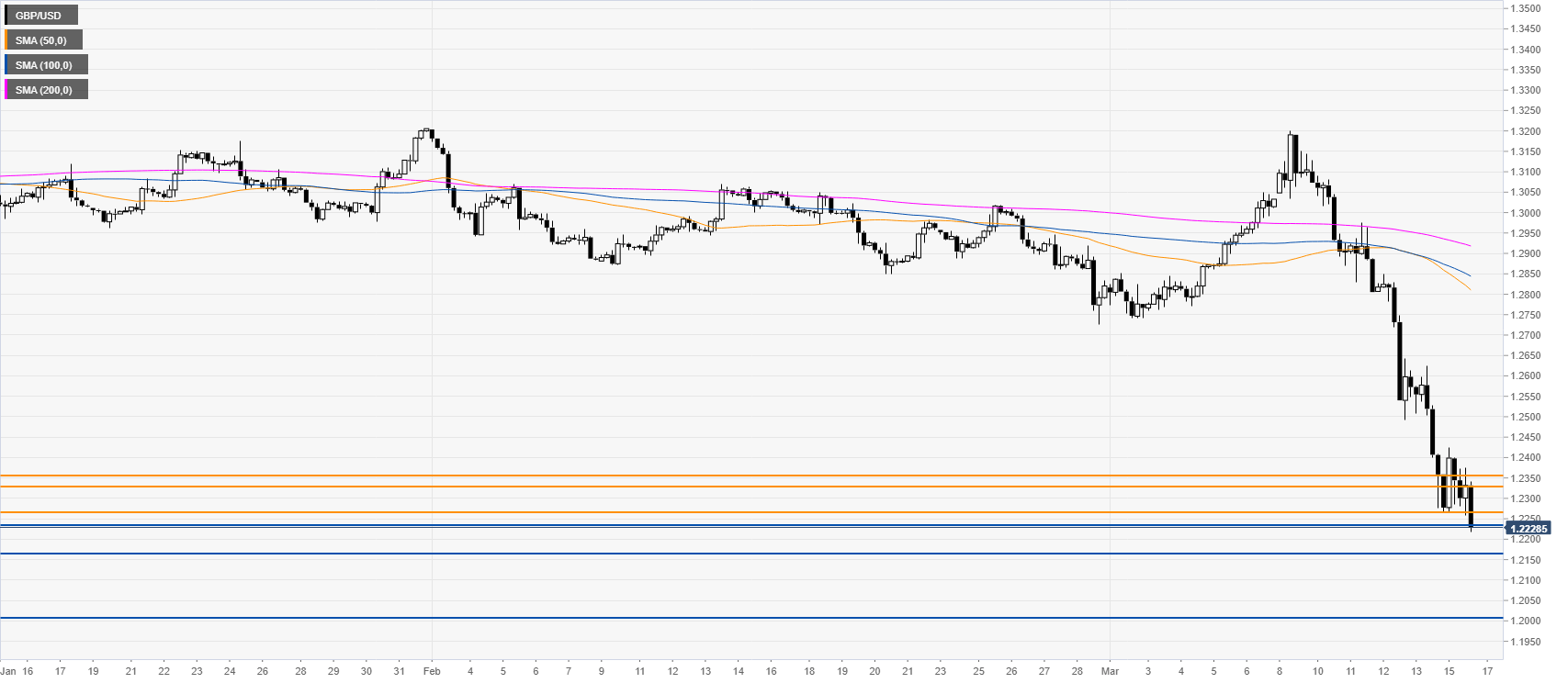

GBP/USD four-hour chart

GBP/USD is under heavy selling pressure in five-month lows trading well bealow its main SMAs. The bears are in control and a break below the 1.2230 support can lead to further losses towards the 1.2160 and 1.2000 figures, according to the Technical Confluences Indicator.

Resistance: 1.2263, 1.2326, 1.2352

Support: 1.2230, 1.2160, 1.2000

Additional key levels