AUD/NZD Price Analysis: Slips below 1.0100 on New Zealand coronavirus package

- AUD/NZD remains on the back foot near the record low flashed the previous day.

- New Zealand government announced additional stimulus worth of 4.0% of GDP after Monday’s surprise rate cut from the RBNZ.

- RBA minutes failed to offer any major clues concerning Thursday’s likely move.

- 50-HMA, short-term falling trend line restricts the pair’s recovery moves.

Having witnessed another effort from New Zealand (NZ) to counter negative implications from the coronavirus (COVID-19), AUD/NZD drops further below 1.0100, currently down 0.50% to 1.0073, during early Tuesday.

The NZ government allocated 4.0% of the GDP, near 12.1 billion New Zealand dollars, to ward off the virus after the RBNZ surprised markets with a 0.75% rate cut the previous day.

It’s worth mentioning that the RBA minutes for March, announced at 00:30 GMT, reiterated the bearish bias among the policymakers but failed to offer any major Aussie moves.

Following the news, AUD/NZD declines further towards Monday’s low of 0.9924. However, 1.0000 psychological magnets may off an intermediate halt during the declines.

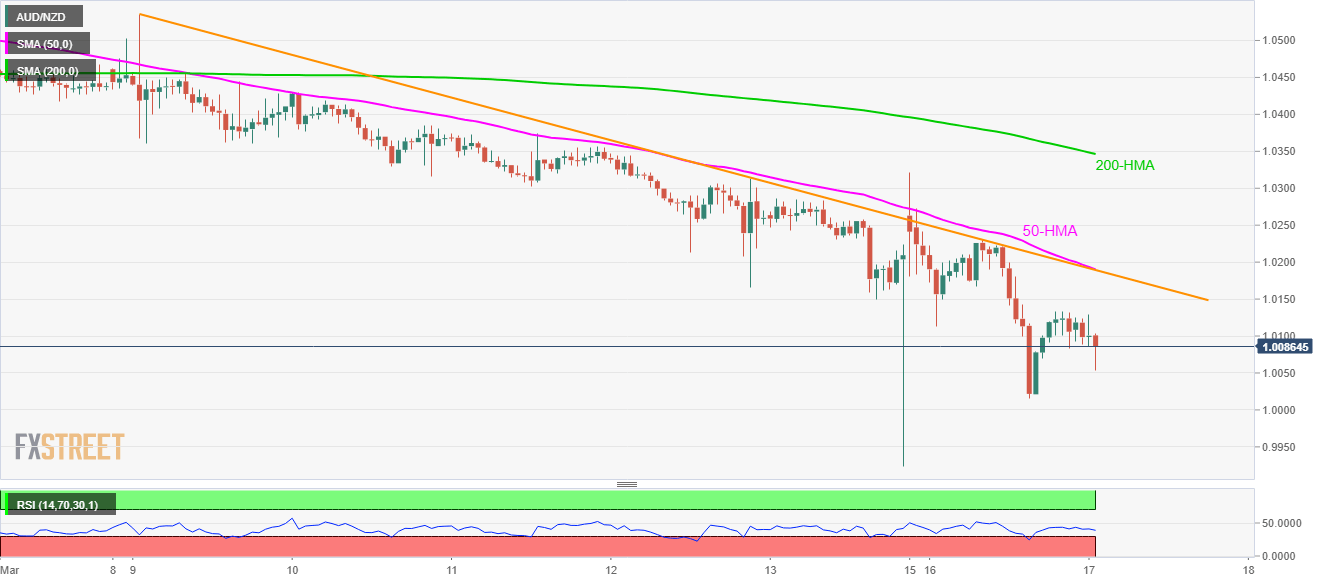

On the upside, a downward sloping trend line since March 09, 2020, as well as 50-Hour Simple Moving Average (HMA), restricts the pair’s short-term recoveries near 1.0190.

Also questioning the pullback beyond 1.0190 will be 200-HMA level close to 1.0350.

AUD/NZD hourly chart

Trend: Bearish