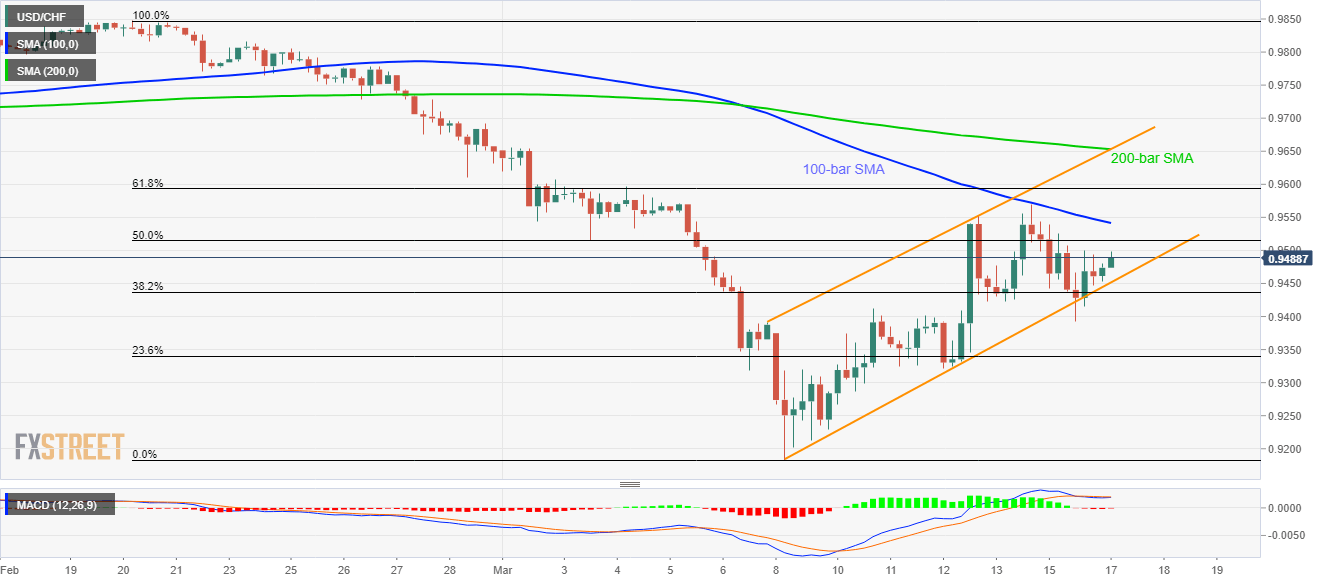

USD/CHF Price Analysis: Below 100-bar SMA inside weekly rising channel

- USD/CHF holds onto recovery gains inside the short-term bullish technical pattern.

- Key SMA, sluggish MACD question the buyers.

In addition to the current risk-reset, USD/CHF takes clues from the technical indicators while rising 0.26% to 0.9493 amid the initial trading session on Tuesday.

The pair recently bounced off the support-line of a one-week-old rising trend channel, which in turn pushes the quote towards a 100-bar SMA level of 0.9540.

However, the quote’s further upside beyond 0.9540 might find it difficult to sustain as 61.8% Fibonacci retracement of the declines from early-February, at 0.9595, can question the buyers.

If at all the bulls manage to conquer 0.9600 round-figure, 200-bar SMA and the resistance line of the said channel around 0.9655 could trigger the pair’s pullback moves.

Meanwhile, a downside break of 0.9450 will defy the bullish technical pattern and can drag the quote towards 0.9400 round-figure.

During the pair’s additional weakness past-0.9400, 0.9320 and the monthly low surrounding 0.9180/85 will be on the bears’ radars.

USD/CHF four-hour chart

Trend: Further recovery expected