EUR/GBP Price Analysis: Refreshes weekly top above 0.8600 on cup-and-handle breakout

- EUR/GBP refreshes one-week top on confirming bullish chart pattern.

- Sustained break of 200-HMA, bullish MACD favor buyers.

- Sellers can return on downside break of eight-day-old horizontal area.

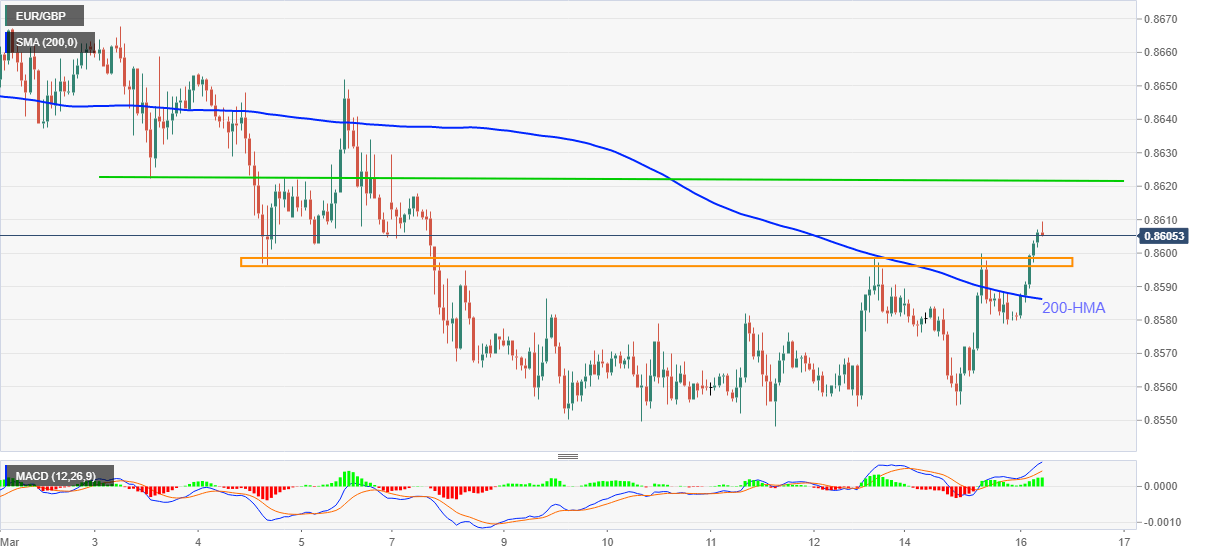

EUR/GBP pierces the 0.8600 threshold, currently up 0.25% intraday, during the pre-European session trading on Tuesday. In doing so, the pair overcomes the multi-month low marked earlier in the month while confirming the bullish cup-and-handle breakout on the hourly (1H) chart.

Not only the bullish chart formation but upbeat MACD and a clear break of 200-HMA also suggest the quote’s further upside towards a two-week-old horizontal resistance around 0.8620.

Though, the EUR/GBP bulls will find multiple upside barriers around the mid-0.8600s during the extended rise.

Meanwhile, sellers are likely to refrain from entering unless witnessing a clear downside break below 0.8595, comprising an eight-day-long horizontal area. Also acting as a downside filter is the 200-HMA level of 0.8586.

In a case where EUR/GBP drops below 0.8586, odds of its another drop to the lowest since February 2020, around 0.8540, can’t be ruled out.

EUR/GBP hourly chart

Trend: Further upside expected