USD/INR Price News: Indian rupee eyes to revisit early 2020 tops around 72.20

- USD/INR stays mildly offered despite recent bounce off intraday low.

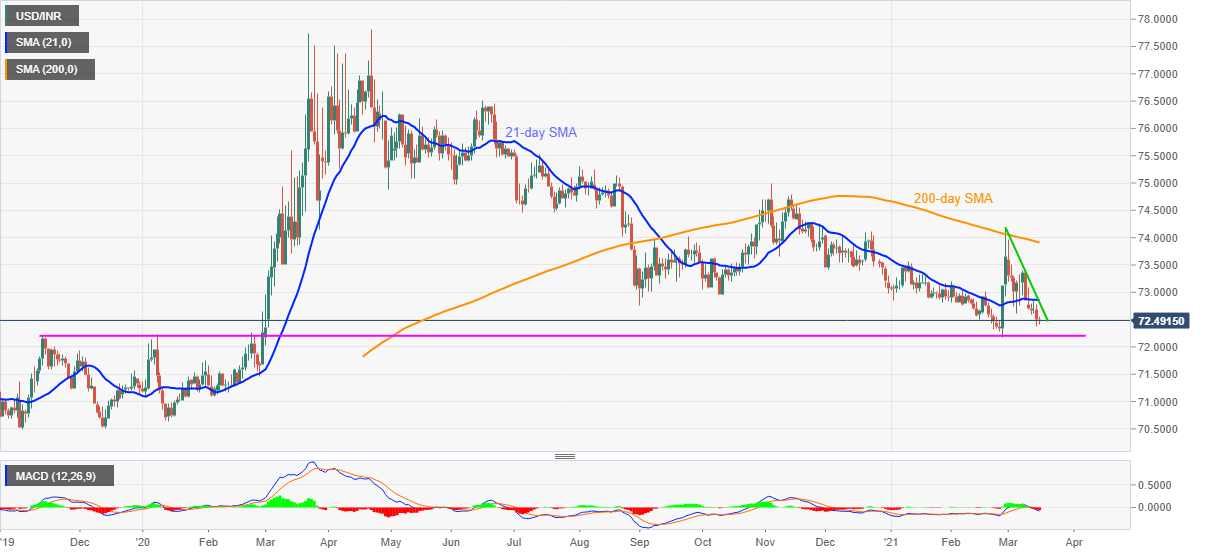

- Confluence of 21-day SMA, two-week-old resistance line guards immediate upside.

- January 2020 peak offers an intermediate halt ahead of the yearly bottom.

- Bearish MACD, failures to recover favor sellers, bulls eye clear break of 200-day SMA for conviction.

USD/INR marks a corrective pullback from an intraday low of 72.40, currently down 0.05% near 72.48, amid the initial Indian trading session on Tuesday.

In doing so, the quote bounces off the lowest since February 25 amid bearish MACD. It’s worth mentioning that sustained trading below the monthly falling trend line and 21-day SMA, not to forget the 200-day SMA, keeps USD/INR sellers hopeful.

However, tops marked during January, around 72.20, offer strong support to the USD/INR prices ahead of the yearly low near 72.18 and the 72.00 threshold.

Meanwhile, recovery moves need to cross the 72.85 resistance confluence including the 21-day SMA and the stated downward sloping trend line to convince USD/INR buyers for entry.

It should be noted that 200-day SMA near 73.90 becomes a tough nut to crack for the USD/INR bulls, below which bears keep the throne.

USD/INR daily chart

Trend: Bearish