Back

17 Mar 2021

Analisis Harga AUD/USD: Pembeli Perhatikan Target Resistance Harian

- Head & Shoulders terbalik bermain untuk pembeli.

- Pembeli AUD/USD mencari lonjakan naik ke resistance harian.

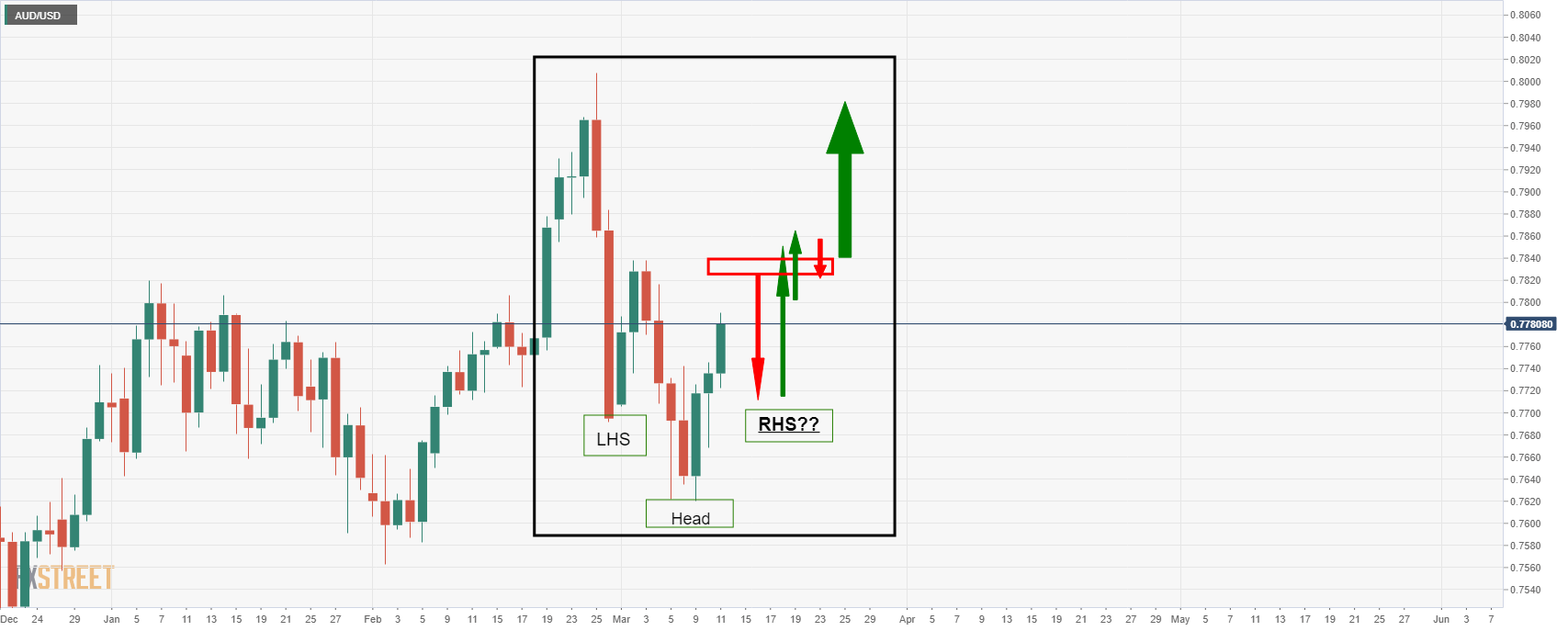

Sesuai analisis sebelumnya, Analisis Harga AUD/USD: Prospek untuk H&S mingguan vs formasi W harian/H&S Terbalik, H&S Terbalik adalah hasil yang paling mungkin pada saat ini.

Analisis sebelumnya, skenario Reverse H&S

Grafik harian menawarkan prospek formasi-W jika harga menembus 78,6% atau skenario yang lebih rumit dalam pembentukan Reverse Head & Shoulders yang bullish:

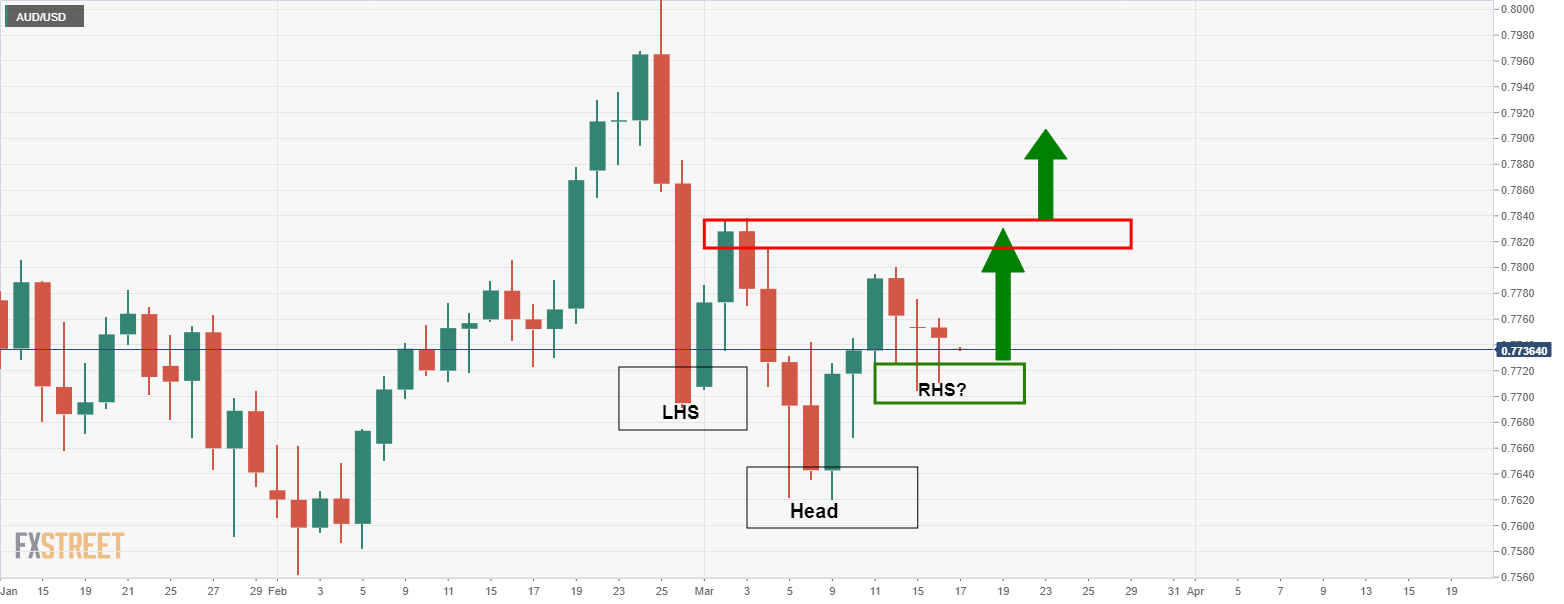

Pasar langsung, grafik harian, H&S Terbalik

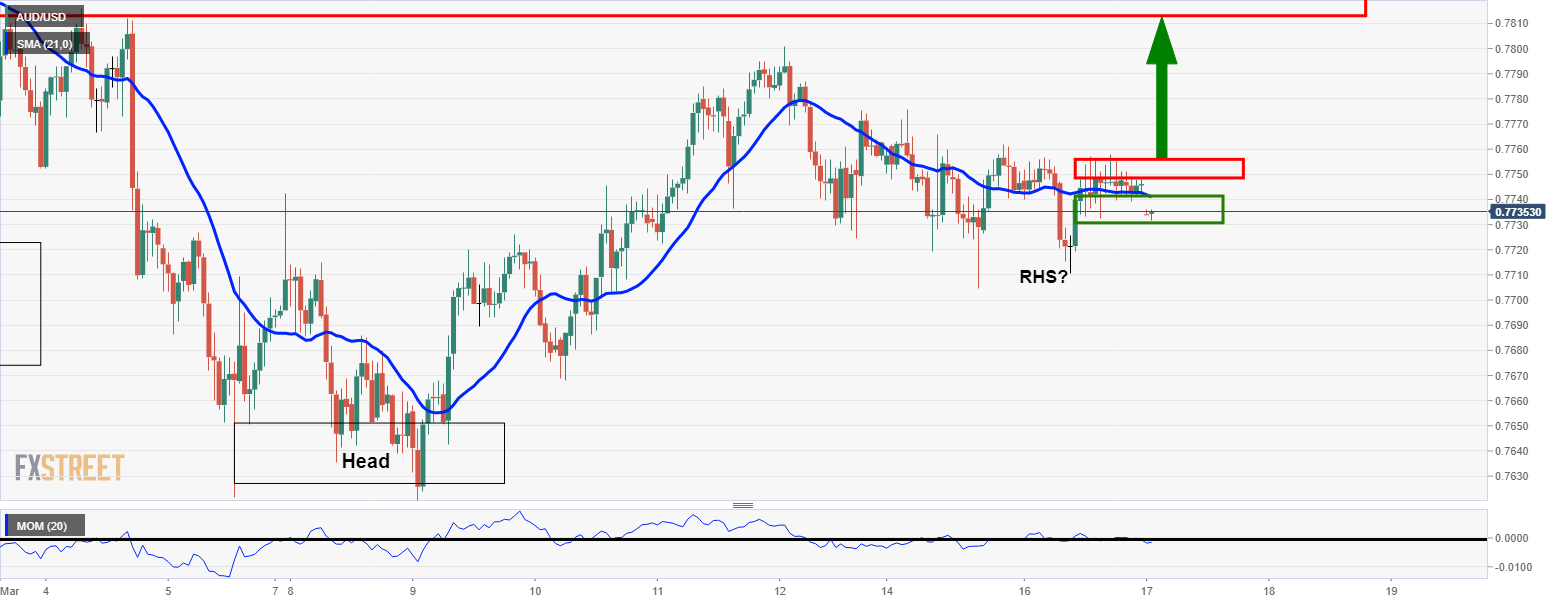

Selama hari itu sejak analisis sebelumnya, grafik harian telah berkembang menjadi formasi bahu kanan (RHS) dari head and shoulders terbalik (RH&S).

Pembeli sedang bermain pada titik support ini dan harga diperkirakan akan bergerak ke atas.

Pembeli dapat memantau kondisi bullish pada kerangka waktu yang lebih rendah untuk menargetkan struktur resistance harian.

Grafik per jam