Back

3 May 2021

AUD/USD Price Analysis: Bulls looking to new daily resistance

- AUD/USD is on the but is making hard work of the upside.

- There are prospects of a meanwhile test of old support on the daily chart.

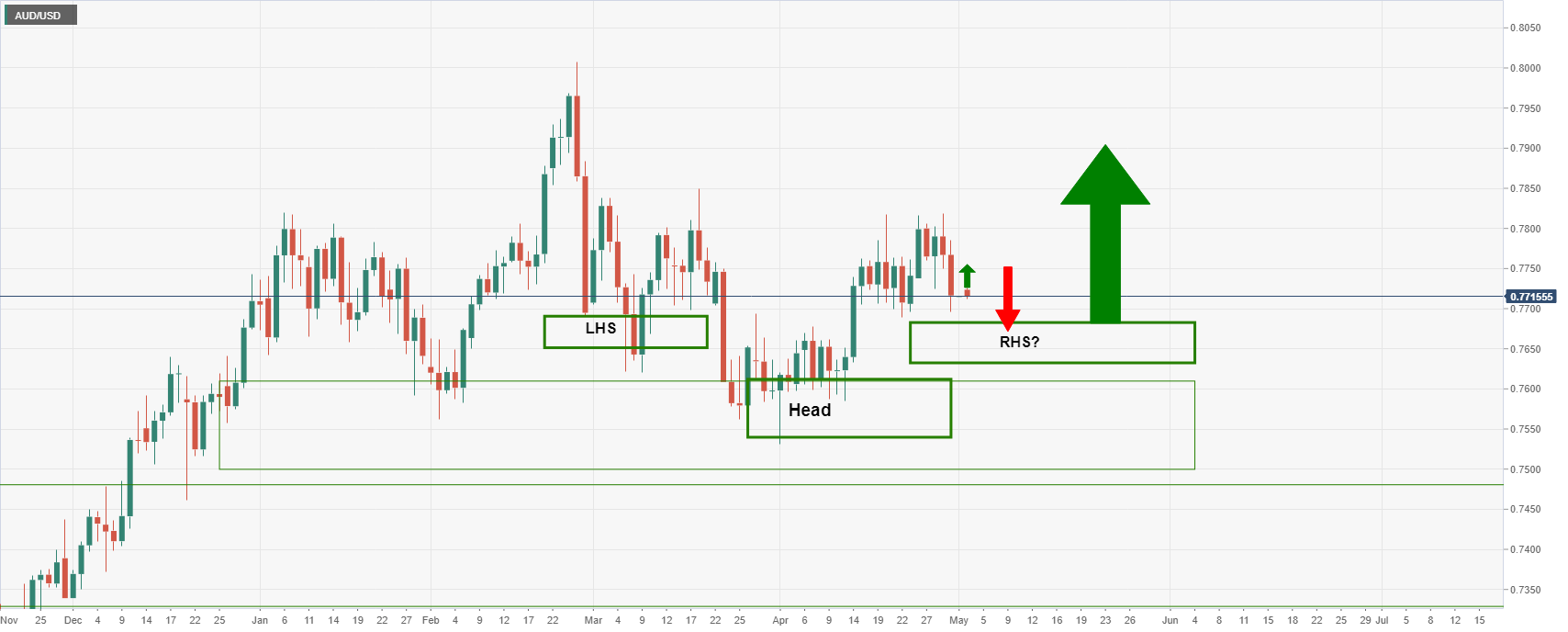

AUD/USD is trapped between support and resistance but there are market structure developments that should be noted for the ope this week as follows:

While the price is trapped between the support and resistance, the bulls are in play and there are prospects of an upside.

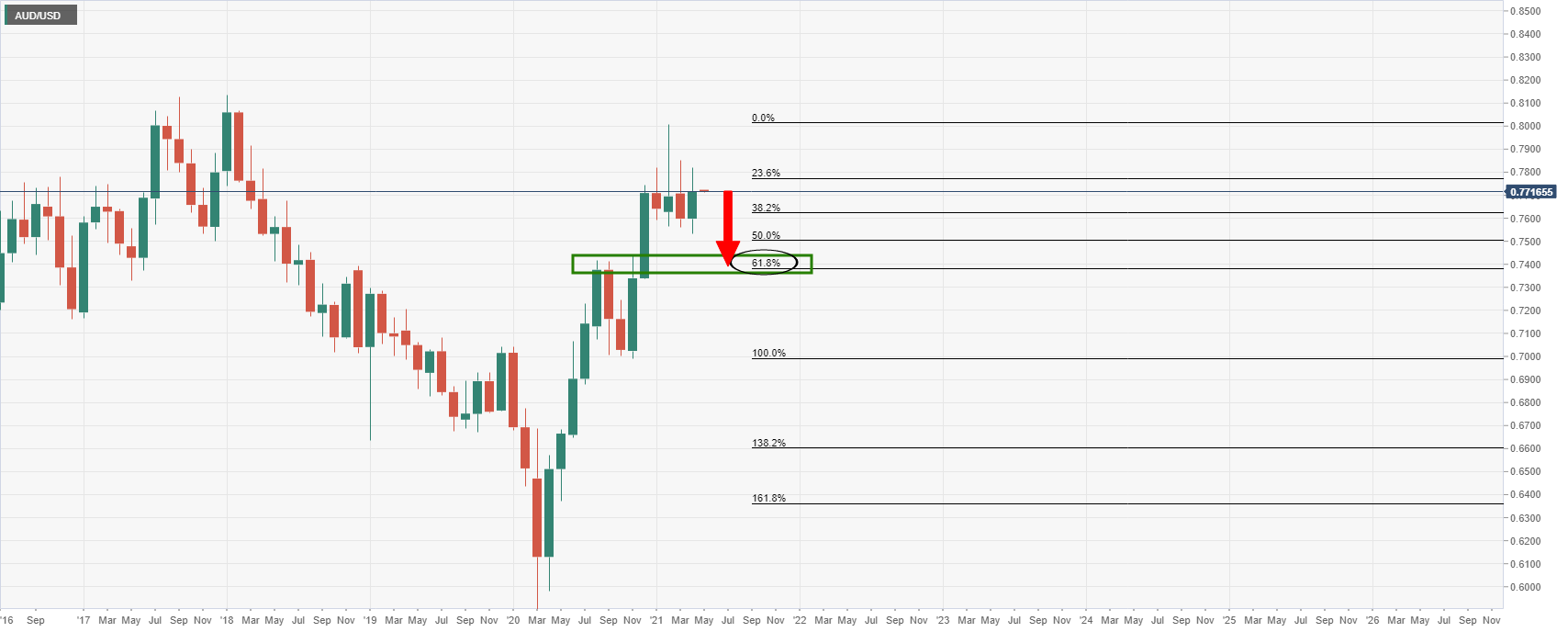

However, a deeper correction to fully test prior resistance is also a possibility.

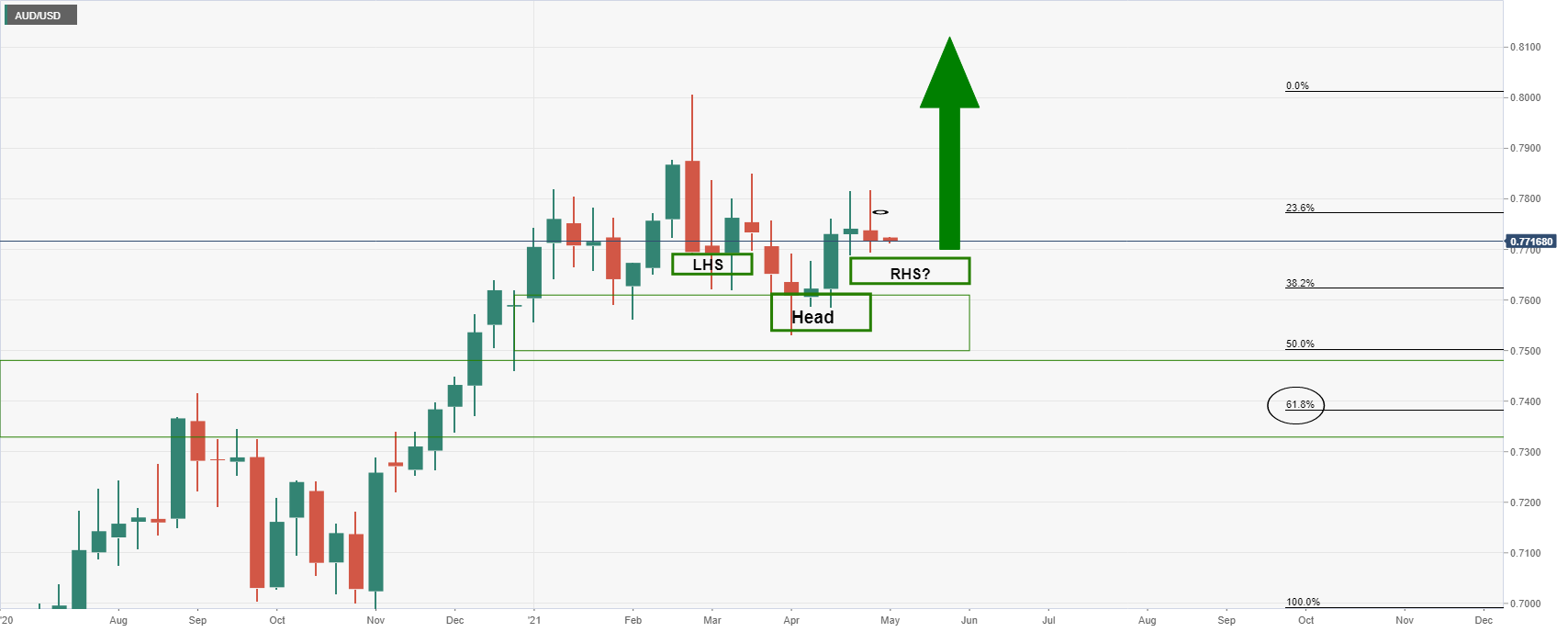

Weekly chart

A weekly outlook shows a reverse head and shoulders which could well see the right-hand shoulder which would be expected to equate to an upside continuation.

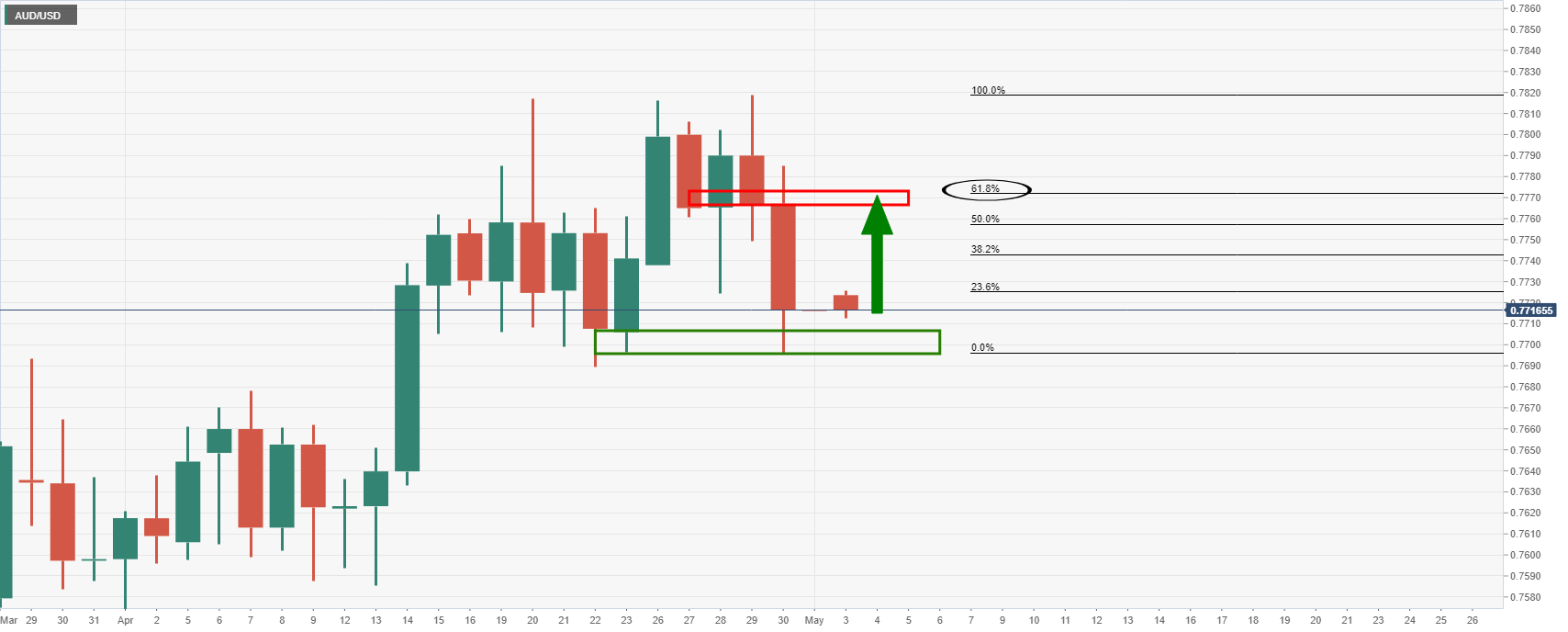

Daily chart

Zooming in, as follows, the bulls can target a 61.8% Fibo retracement which has a confluence with the prior support.