Back

29 Jul 2021

Crude Oil Futures: Gains seem short-lived

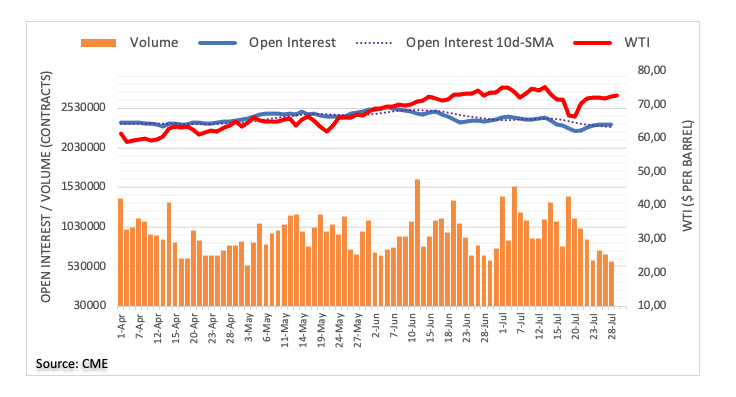

CME Group’s flash data for crude oil futures markets noted open interest shrank by around 8.3K contracts after five straight daily builds. Volume followed suit and dropped for the second session in a row, now by nearly 81K contracts.

WTI faces some consolidation near term

Wednesday’s uptick in WTI was fuelled by short covering, as noted by shrinking open interest and volume. Against that, further upside could be losing momentum and the door could open to some consolidation or even a corrective downside in the very near term.