AUD/NZD Price Analysis: Bears are beating down the doors

- AUD/NZD bears are lurking above critical support.

- A break of the near-term support would be significant.

AUD underperformed overnight in comparison to its rival commodity currencies, reflecting the concerns around the Sydney lockdown and the implications this will have for next week’s Reserve Bank of America meeting.

This offers a downside prospect for the bears in what is a longer-term bearish environment.

The following is a top-down analysis that arrives at a bearish conclusion for the days ahead.

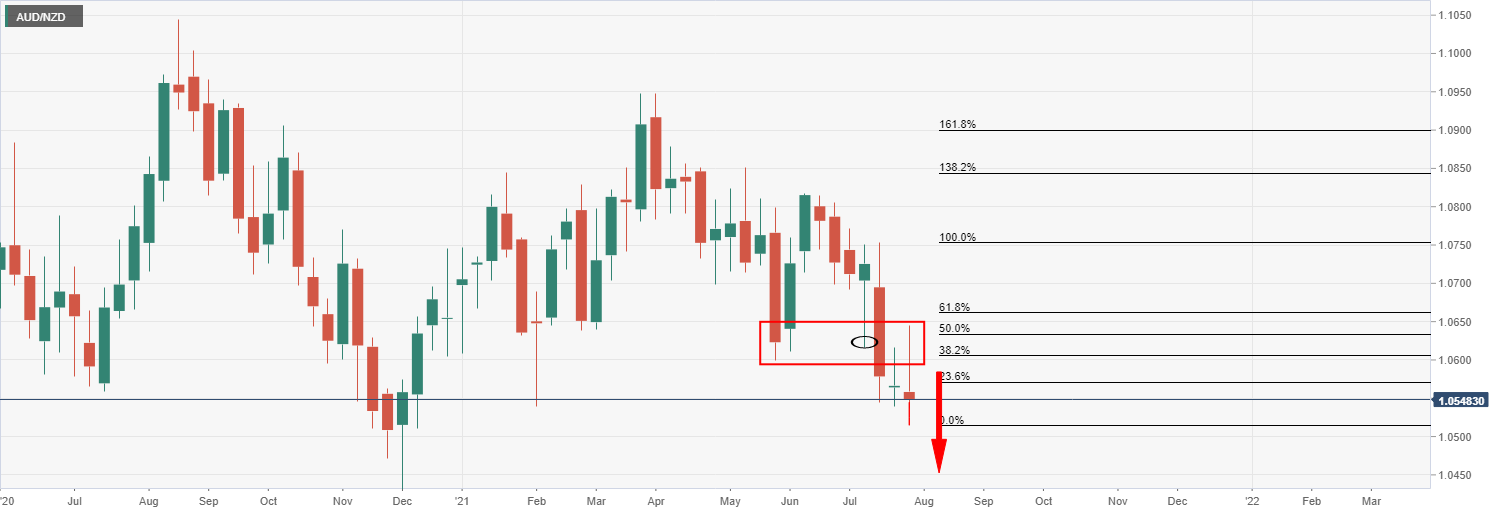

Weekly chart

From a weekly perspective, the price has already been rejected from a firm resistance area and high up on the Fibonacci scale near the 1.0620/50s.

Daily chart

From a daily perspective, the bearish engulfing is setting the stage for further downside.

4-hour chart

Ideally, the market would move a touch higher for additional liquidity before embarking on a grand test below the longer-term support structure.