Back

2 Aug 2021

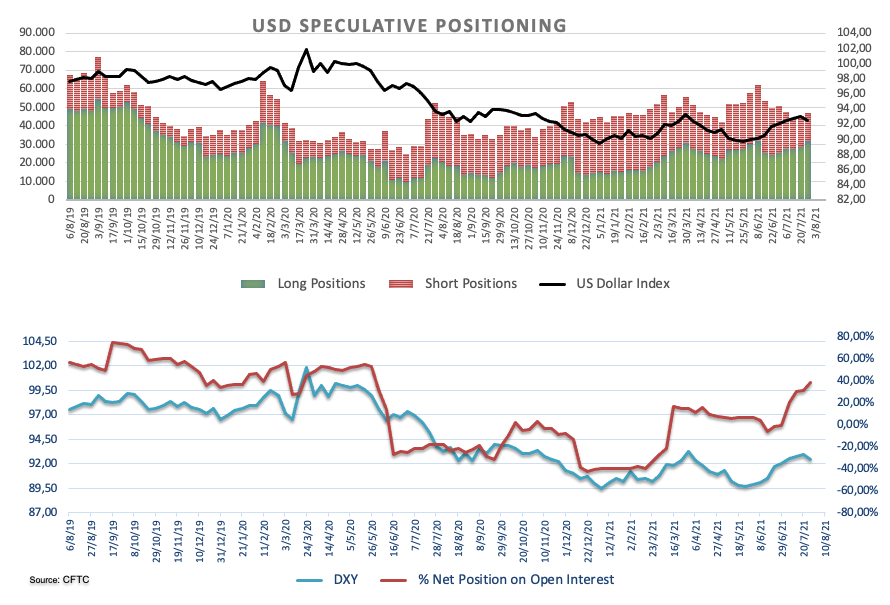

CFTC Positioning Report: USD net longs at 15-month highs

These are the key points of the CFTC Positioning Report for the week ended on July 27th:

- Speculators added gross longs to their USD positions for the fifth consecutive week, taking the net longs to levels last seen in mid-May 2020. The DXY pushed higher and clinched new tops beyond the 93.00 during that week ahead of the key FOMC event just past the cut-off date. The risk-off environment on the back of renewed COVID-19 concerns and expectations of a hawkish surprise at the Fed meeting encouraged traders to keep favouring the buck.

- By contrast, EUR net longs dropped to levels last seen in mid-March of the last year. Fears around the Delta variant and its impact on growth prospects fuelled inflows into the safe haven universe in detriment of the risk complex. EUR/USD breached the 1.1800 mark to record fresh lows around 1.1750 in the spot market, reflecting the persistent risk-off mood.

- Opposing moves in the safe haven galaxy saw net shorts in JPY rising to 3-week highs, while net longs in CHF also increasing to multi-week tops.

- Net shorts in GBP went up to the area last recorded in early December 2020 on the back of dollar’s strength, doubts around “Freedom Day” and mitigating bets on a hawkish BoE in the relatively short-term horizon.