Our best spreads and conditions

Learn more

Learn more

GBP/USD has printed a fresh high in New York trade. At 1.3519, the price is 0.56% on the day after rallying from a low of 1.3433. Cable is up for a third straight session as strong domestic economic data and hawkish sentiment surrounding the Bank of England coupled with a weak US dollar leaves bulls in control.

Thursday will see a UK Monetary Policy Committee meeting, where a rate hike is likely. Investors have now fully priced a 25-basis-point rise in the BoE's main interest rate to 0.50% on Feb. 3. Therefore, the focus ought to be on what's said, more than what's done.

Pricing for UK rate hikes this year is the same as for the US - 5 in total. The Bank of England is expected to start running down its bond holdings on 7 March. However, amid fears the central bank might be behind the curve when it comes to tackling inflation, there is uncertainty over the pace at which it will raise rates and the level at which they will peak. Traders are also wondering how soon and how fast the bank will start reducing its balance sheet and stop reinvesting maturing gilts.

Encouragingly for sterling bulls, a survey showed British manufacturing output grew at the fastest pace in six months in January. This is supporting the view that the British economy is still handsomely rebounding from the COVID-19 recession. Additionally, the political crisis in Britain over lockdown parties at Downing Street has not had a significant impact on investors appetite for the pound. However, opinion polls showing a majority of voters felt Prime Minister Boris Johnson should resign, so this could come back to bite the bulls once the BoE premium is eventually discounted; The pound might not be able to stay strong on the BoE indefinitely.

''On the assumption that the government does proceed with its tax hike in April, we see the risk that the market will unwind some of its assumptions on BoE rates and this could leave the pound vulnerable in the spring and early summer,'' analysts at Rabobank argued. '' Given our view that the USD will be buoyed as Fed tightening commences, we see a risk that cable could dip below the 1.30 level in the middle of the year.''

Meanwhile, the US dollar is under pressure and has fallen for a second consecutive session on Tuesday. Weaker-than-expected US economic data and less hawkish Federal Reserve officials who have pushed back against aggressive rate hikes this year have weighed. This too has helped the British pound to gain ground as risk appetite returns. Wall Street shares are also higher.

A series of Federal Reserve officials said on Monday that they would raise interest rates in March, but they have spoken cautiously about what might follow. That has taken the sting out of Fed's Powell's more hawkish tone from the recent Fed, meeting and presser that followed.

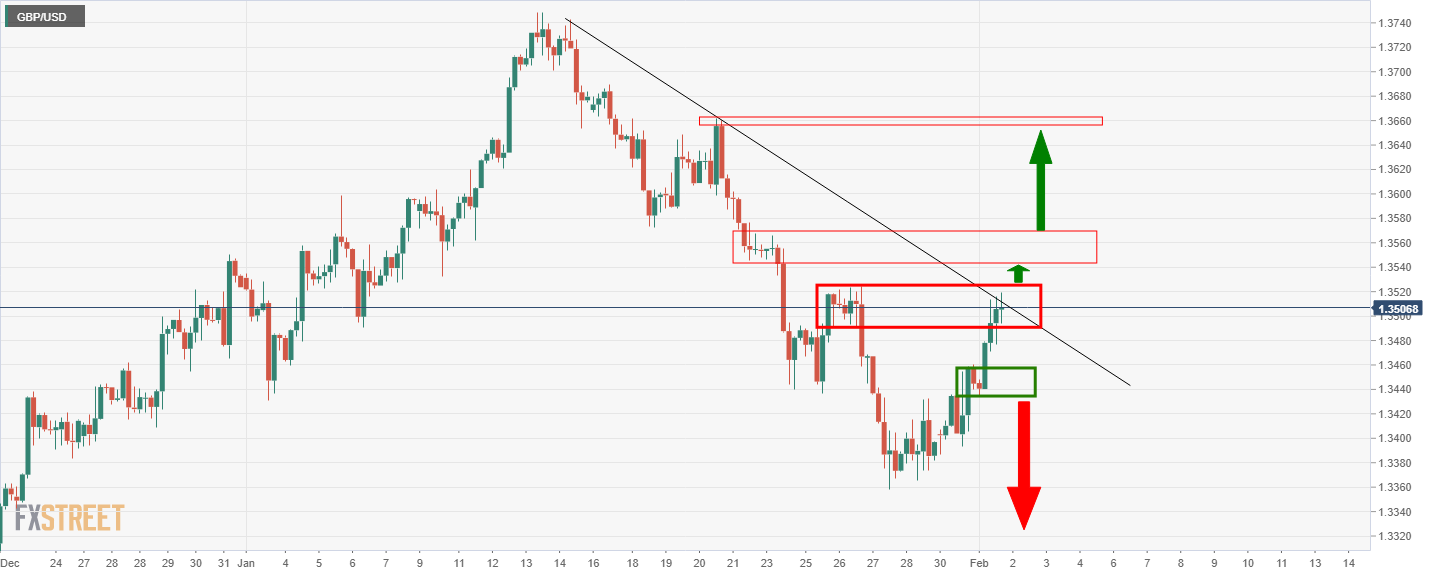

The price has shot into 4-hour liquidity where resistance could see the bulls struggle from here around the descending trendline. Having said that, a break of 1.3525 could open the doors to 1.3575 as the last defence for a significant move high towards 1.3680.